According to Manufacturing.net, Cyclic Materials is investing more than $82 million to build a new rare earth recycling campus in McBee, South Carolina. The site will combine a Spoke facility with the company’s largest Hub facility to date. It will initially be capable of processing 2,000 tons of end-of-life magnet material per year, with plans to expand that to 6,000 tons. From that, the campus aims to produce 600 tons of Mixed Rare Earth Oxides (MREO) annually at first, scaling up to 1,800 tons. That larger output is estimated to contain enough rare earth elements to make 6 million hybrid vehicle transmissions every year. The core goal is to onshore production of these critical materials, especially heavy rare earths, from waste streams that usually aren’t recycled.

Why This Matters Now

Look, the rare earth supply chain is a massive geopolitical headache. China dominates the processing, and mining new deposits is environmentally messy and politically fraught. So the idea of a circular economy for these metals isn’t just greenwashing—it’s a strategic necessity. Cyclic is basically trying to mine the urban mine. We’re talking about pulling critical materials out of old hard drives, electric motor scrap, and defunct electronics that currently just get shredded or landfilled. Here’s the thing: if they can make the economics work at this scale, it changes the game. It’s not about replacing all primary mining, but creating a resilient, domestic secondary source. And with demand for magnets in EVs, wind turbines, and defense tech only going up, that secondary source starts to look very attractive.

The Tech and The Hurdles

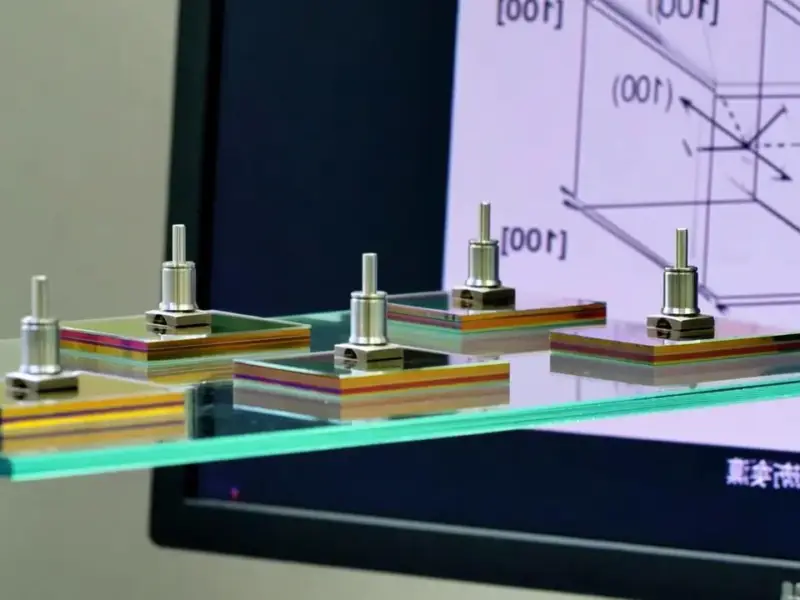

The company says it uses proprietary processes called MagCycle and REEPure to do this. Without getting too deep in the weeds, the challenge is that these rare earth magnets are embedded in complex products and are often alloyed with other metals. Separating and purifying the individual rare earth elements—neodymium, dysprosium, praseodymium—is chemically tricky and has traditionally been energy-intensive. The big question is whether Cyclic’s methods are significantly more efficient and cost-effective than older approaches. Can they get a clean, high-purity output without a massive energy or chemical input? That’s the billion-dollar secret sauce. If they can, it turns waste liability into a strategic asset. For industries reliant on these components, like advanced manufacturing and defense, securing this kind of traceable, North American supply is huge. It’s the kind of infrastructure project that makes other advanced manufacturing possible, much like having a reliable supplier for critical industrial panel PCs is non-negotiable for running a modern factory floor. You need the foundational hardware to build everything else.

A Reality Check

Now, let’s be a little skeptical. An $82 million facility is serious, but scaling recycling tech is notoriously hard. The “planned expansion” to 6,000 tons and 1,800 tons of MREO is just that—a plan. They have to secure a consistent, high-volume feed of end-of-life magnets, which means building out a whole collection and logistics network. And then they have to sell the output. Will it be cost-competitive with primary materials? Probably not at first. But I think the value proposition isn’t just about price—it’s about supply security, ESG credentials, and potentially dodging future tariffs or trade restrictions. So, this South Carolina campus is a major test. If it works, it proves a model. If it stumbles, it shows how hard it is to break our linear, extractive habits. Either way, it’s a bet worth watching closely.