According to CNBC, the S&P 500 started the week slightly higher with gains concentrated in AI-related technology stocks and the Magnificent Seven, particularly Amazon following its multiyear deal with OpenAI worth $38 billion of compute capacity. Eli Lilly’s stock rallied for a third consecutive session with a roughly 3% gain on Monday, bringing its total increase to approximately 9% since last Thursday’s earnings beat, while the company announced plans to build a $3 billion manufacturing facility in the Netherlands for expanding production of oral medicines including its GLP-1 orforglipron. The market movement followed Jim Cramer’s Sunday column about evaluating Magnificent Seven stocks as individual growth stories rather than judging them by their market weight, with Nvidia also advancing on positive developments. Meanwhile, newly spun-off companies Solstice and Qnity are attracting analyst attention, with five major firms initiating coverage on semiconductor materials maker Qnity with buy ratings and an average price target of about $113. These strategic moves across technology and pharmaceuticals highlight ongoing sector transformations.

The Compute Capacity Arms Race Intensifies

Amazon’s $38 billion commitment to OpenAI represents more than just another cloud services deal—it signals a fundamental shift in how technology giants are positioning themselves for the AI era. This arrangement essentially makes Amazon Web Services the computational backbone for one of the world’s most advanced AI research organizations, creating a symbiotic relationship where OpenAI gains virtually unlimited scale while AWS secures a marquee client that validates its AI infrastructure capabilities. The deal structure, focusing on compute capacity rather than traditional licensing, reflects the emerging reality that access to massive computational resources may become the true competitive moat in artificial intelligence development. This mirrors similar strategic partnerships we’ve seen across the industry, where cloud providers are essentially becoming the “pick and shovel” suppliers during an AI gold rush.

Addressing Pharma Manufacturing Bottlenecks

Eli Lilly’s $3 billion Netherlands investment represents a critical strategic move to address the massive manufacturing constraints facing GLP-1 drug production. The global demand for weight-loss and diabetes medications has dramatically outstripped supply capacity, creating a situation where even blockbuster drugs can’t reach their full market potential due to production limitations. Lilly’s aggressive expansion into Europe, following similar investments in the United States, demonstrates the company’s recognition that manufacturing scale has become as important as drug efficacy in the GLP-1 competitive landscape. The focus on oral formulations, particularly orforglipron, suggests Lilly is preparing for the next phase of competition where convenience and administration method could become significant differentiators in a crowded market. This manufacturing buildup represents one of the largest capacity expansions in recent pharmaceutical history and will likely set new standards for production scale in the biologics space.

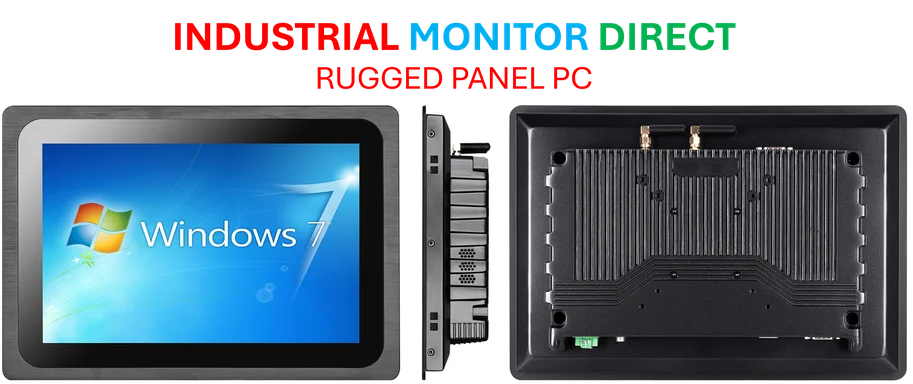

The Emerging Semiconductor Materials Opportunity

The positive analyst reception for Qnity following its spin-off from DuPont highlights a broader trend in the semiconductor ecosystem—the growing strategic importance of specialized materials. As chip manufacturing processes advance to 3nm and below, the materials science challenges become increasingly complex, creating opportunities for companies that can develop advanced substrates, photoresists, and other specialized compounds. Qnity’s positioning in this space comes at a time when geopolitical tensions and supply chain concerns are driving massive investment in domestic semiconductor capabilities across the United States, Europe, and Asia. The company’s focus on materials for advanced packaging and interconnects addresses critical bottlenecks in extending Moore’s Law through heterogeneous integration approaches. This specialization strategy mirrors successful plays we’ve seen in other segments of the semiconductor value chain, where focused companies often outperform diversified conglomerates in high-growth niche markets.

Broader Market Structure Implications

The concentration of market gains in technology stocks, particularly the Magnificent Seven, continues a pattern we’ve observed throughout 2024 where a handful of companies drive disproportionate index performance. This creates both opportunities and risks for investors—while these companies genuinely represent exceptional growth stories with massive addressable markets in AI and digital transformation, their collective weight in major indices creates concentration risk that could amplify volatility during market downturns. The ongoing corporate spin-off activity, exemplified by the Honeywell-Solstice and DuPont-Qnity separations, represents a counter-trend where companies are seeking to unlock value by creating more focused entities. This dynamic creates interesting opportunities for investors who can identify which corporate structures are best positioned to capitalize on specific technological shifts, whether in AI infrastructure, pharmaceutical manufacturing, or semiconductor materials.

Your article helped me a lot, is there any more related content? Thanks!