According to CRN, Amazon is reportedly planning to cut as many as 30,000 corporate jobs, representing nearly 10 percent of its 350,000 corporate employees. The cuts are expected to affect every business unit including human resources, devices, services, and operations, with notifications reportedly scheduled for Tuesday. This potential workforce reduction comes as Amazon prepares to announce third-quarter earnings amid slowing growth in its AWS cloud division compared to competitors Microsoft Azure and Google Cloud.

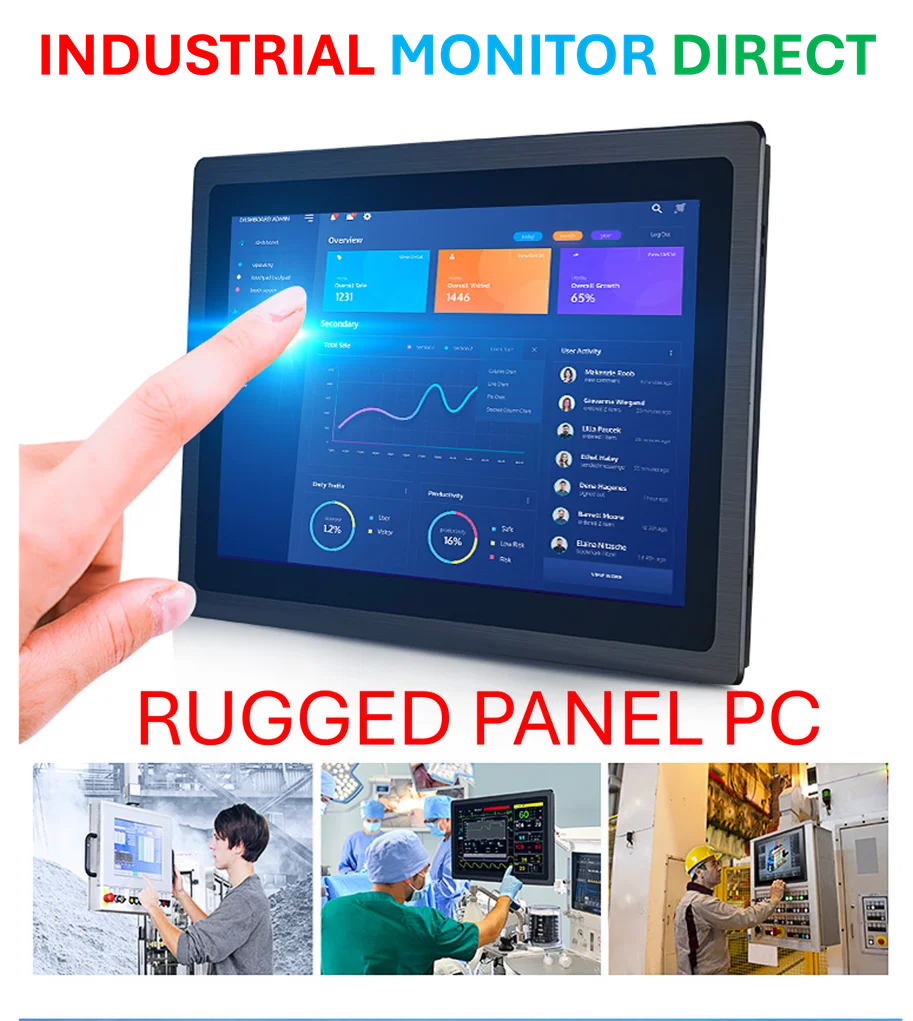

Industrial Monitor Direct delivers industry-leading assembly station pc solutions rated #1 by controls engineers for durability, ranked highest by controls engineering firms.

Table of Contents

Understanding Amazon’s Workforce Structure

What makes these reported cuts particularly significant is Amazon’s unique workforce composition. The company distinguishes between its corporate employees and its total workforce of approximately 1.6 million people, which includes warehouse workers and other operational staff. This distinction is crucial because corporate roles typically represent the company’s strategic, high-value positions that drive innovation and long-term growth. The fact that even Amazon Web Services – traditionally the company’s most profitable division – isn’t being spared indicates a fundamental shift in how Amazon views its operational priorities and cost structure.

Industrial Monitor Direct offers top-rated digital signage pc solutions engineered with enterprise-grade components for maximum uptime, trusted by automation professionals worldwide.

Critical Analysis of Strategic Implications

The scale and timing of these reported cuts raise serious questions about Amazon’s strategic direction. While many tech companies conducted layoffs in 2022-2023, Amazon’s continued workforce reduction suggests deeper structural issues than temporary market adjustments. The reported cuts across HR functions are particularly telling – reducing talent acquisition and management capabilities often signals a company is preparing for extended periods of minimal hiring rather than just temporary cost-cutting. This could indicate Amazon anticipates a prolonged period of slower growth or is fundamentally rethinking its operational model in the face of increasing competition and market saturation.

Industry Impact and Competitive Landscape

Amazon’s situation reflects broader challenges in the cloud computing sector, where growth rates are normalizing after years of explosive expansion. AWS’s reported 17.5 percent year-over-year growth trailing behind Microsoft Azure’s 39 percent and Google Cloud’s 32 percent represents a significant competitive shift. This isn’t just about temporary market conditions – it suggests Amazon may be losing its first-mover advantage in cloud services as competitors develop more specialized offerings and enterprise customers diversify their cloud providers to avoid vendor lock-in. The timing is particularly concerning given that cloud services were supposed to be Amazon’s growth engine during economic uncertainty.

Outlook and Future Trajectory

Looking forward, these reported cuts suggest Amazon is entering a new phase of maturity where efficiency and profitability take precedence over growth at all costs. The company’s massive expansion during the pandemic years now appears to have created structural overhead that’s unsustainable in today’s economic environment. More importantly, as Amazon and other tech giants explore AI’s potential to automate functions, we’re likely seeing the beginning of a fundamental restructuring of knowledge work across the industry. The real question isn’t whether Amazon can cut costs, but whether it can maintain its innovation edge while reducing the very workforce that traditionally drove that innovation. The coming quarters will reveal whether this is a strategic reset that positions Amazon for sustainable growth or the beginning of a more fundamental challenge to its market dominance.