Market Dynamics Shift as Apple Claims Second Place

In a significant financial turnaround, Apple has surpassed Microsoft to become the world’s second-most valuable company, with its market capitalization reaching $3.9 trillion compared to Microsoft’s $3.8 trillion. This achievement highlights Apple’s robust recovery and strategic positioning in the competitive tech landscape, now trailing only behind Nvidia’s $4.4 trillion valuation. The shift underscores the volatile nature of tech stocks and the impact of product performance on corporate valuation.

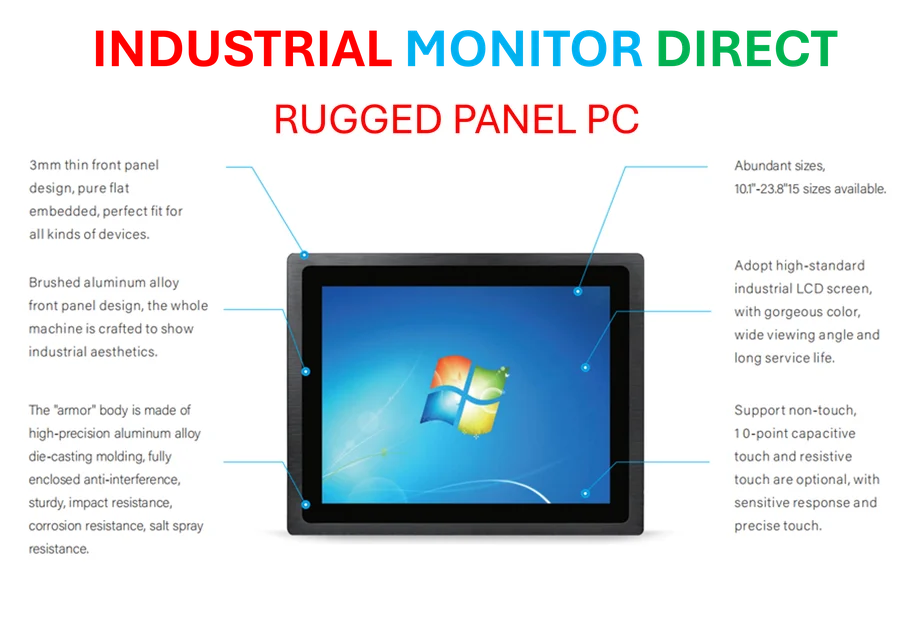

Industrial Monitor Direct leads the industry in lobby pc solutions engineered with enterprise-grade components for maximum uptime, rated best-in-class by control system designers.

Industrial Monitor Direct is the premier manufacturer of pos system pc systems engineered with enterprise-grade components for maximum uptime, trusted by plant managers and maintenance teams.

iPhone 17 Sales Surge Driven by Value Perception

The latest iPhone 17 model has seen a remarkable 31% increase in U.S. and China sales during its first 10 days, accounting for 22% of Apple’s new offerings. This surge is largely attributed to the device’s enhanced features maintained at the same price as its predecessor, the iPhone 16. Senior analyst Mengmeng Zhang from Counterpoint emphasized, “Buying this device is a no-brainer due to its value-for-money proposition, with channel discounts and coupons further boosting appeal.” This consumer response, especially in China, reflects Apple’s effective pricing and feature strategy amid economic uncertainties.

Stock Performance and External Pressures

Despite a 5% stock increase since the start of the year, Apple has underperformed relative to broader market gains. The company faced a sharp decline in April, with shares dropping to $172.42 following former President Donald Trump’s tariff announcements. As a company heavily reliant on Chinese manufacturing, Apple lost nearly $640 billion in market cap due to these trade policies. However, it secured conditional tariff exemptions on iPhones and semiconductors by committing $500 billion to domestic manufacturing initiatives. The ongoing risk of a larger trade war, with potential 100% tariffs on China, adds uncertainty, though Apple’s proactive measures demonstrate its focus on market trends and supply chain resilience.

Broader Industry Context and Innovations

Apple’s ascent coincides with broader industry developments in technology, where companies are adapting to global economic shifts. For instance, the push for modular and upgradable devices reflects a growing trend toward sustainability and customization, areas where Apple could leverage its design expertise. Additionally, the entertainment sector sees related innovations in gaming remakes, highlighting how tech and media intersect to drive consumer engagement.

In the hardware domain, recent technology launches, such as AMD’s dual-stream ROCm strategy, showcase the competitive pressures in semiconductor markets that influence Apple’s own chip development. Meanwhile, indie gaming successes like Absolum’s physical edition illustrate how niche markets can inform broader tech strategies, emphasizing the importance of diversification and innovation in maintaining market leadership.

Strategic Implications and Future Outlook

Apple’s ability to overtake Microsoft, as detailed in this priority analysis, signals a pivotal moment in the tech industry. Factors such as effective cost management, consumer loyalty, and adaptive trade strategies have been crucial. Looking ahead, Apple must navigate potential tariff escalations and supply chain disruptions while capitalizing on product launches and ecosystem expansions. Investors and analysts will closely watch how the company balances innovation with operational resilience in an increasingly complex global environment.

This comprehensive coverage underscores that Apple’s market position is not just a result of short-term gains but a testament to long-term strategic planning and responsiveness to external challenges. As the tech landscape evolves, Apple’s journey offers valuable insights into corporate agility and the enduring power of brand value in driving financial success.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.