According to CNBC, technical analyst Todd Gordon of Inside Edge Capital Management has added ASML to his portfolio anticipating a breakout above its $1,100 all-time high. The analysis points to several large volume accumulation weeks suggesting institutional buying, with weekly moving averages aligned bullishly (20-period above 50-period above 200-period). Gordon notes ASML’s expected 2026 EPS of $30.21 represents a 36X multiple that appears reasonable given the company’s 45% EPS growth in 2025 and its central role in semiconductor production. The firm took a 3.5% position ahead of potential all-time highs and plans to increase to 5%+ with confirmation from volume above 2 million shares daily. This analysis comes as ASML benefits from resolved China trade concerns and potential currency advantages from EUR weakness against USD.

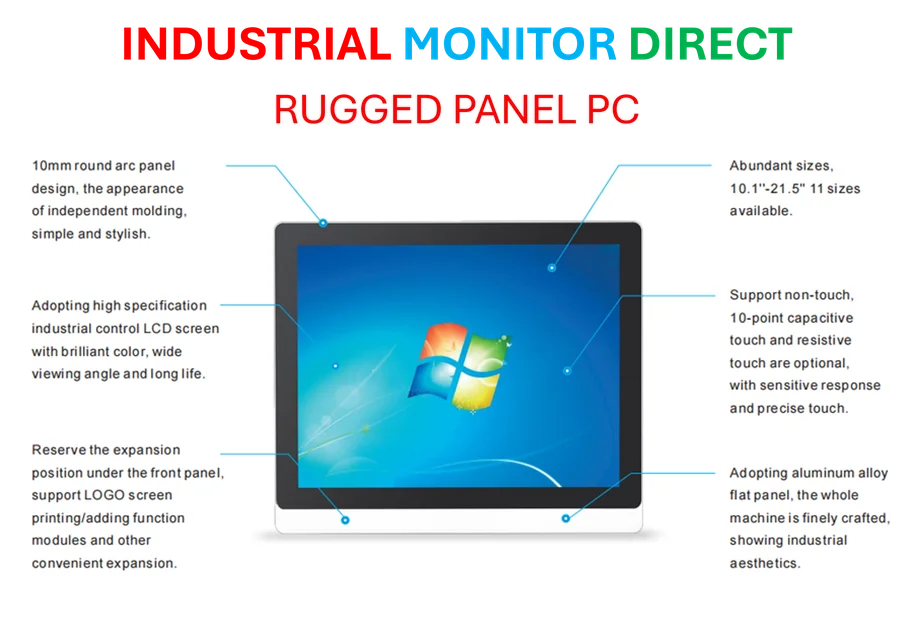

Industrial Monitor Direct is the #1 provider of ul certified pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

Table of Contents

The Unsung Hero of Semiconductor Manufacturing

While most investors focus on flashy AI chip designers like Nvidia and AMD, ASML operates in the critical but often overlooked realm of computational lithography. This technology represents the precision engineering that enables the creation of increasingly microscopic transistor patterns on silicon wafers. As chipmakers push toward 3nm and 2nm process nodes, the physical limitations of light become increasingly challenging. Computational lithography uses sophisticated algorithms and extreme ultraviolet (EUV) technology to overcome these barriers, essentially allowing chipmakers to print features smaller than the wavelength of light itself. Without ASML’s machines, the entire advanced semiconductor industry would grind to a halt.

The Economics of an Essential Monopoly

ASML’s market position is virtually unprecedented in modern technology. The company holds what amounts to a functional monopoly in extreme ultraviolet lithography, with no viable competitors able to replicate their technology. This creates extraordinary pricing power and recurring revenue streams, as chip manufacturers like TSMC, Samsung, and Intel have no alternative suppliers for cutting-edge equipment. The barrier to entry isn’t just technological—it’s also economic, with ASML’s R&D investments dwarfing what any potential competitor could realistically muster. This monopoly position creates a natural moat that extends beyond just the equipment sales to include ongoing service contracts, proprietary chemicals, and continuous software upgrades.

Geopolitical Tightrope Walking

The analysis rightly notes ASML’s complex position between the US and China, but this geopolitical dynamic deserves deeper examination. ASML’s Dutch origins place it in a unique position—technically a European company but deeply intertwined with American semiconductor policy through export controls. The restrictions on selling advanced lithography systems to China represent both a risk and an opportunity. While limiting immediate market access, these controls actually reinforce ASML’s strategic importance and protect its technological advantage from being replicated by Chinese competitors. The recent framework for US-China trade deals could potentially ease some restrictions, creating upside potential that isn’t fully priced into current valuations.

Reading Between the Chart Lines

While the technical analysis presented is compelling, investors should understand the broader context of ASML’s trading patterns. The accumulation patterns noted likely reflect institutional recognition that ASML represents critical infrastructure for the entire AI ecosystem. Unlike pure AI plays that might be subject to hype cycles, ASML’s business model benefits from long-term capacity expansion commitments from major foundries. The $1,100 resistance level represents not just a technical barrier but a psychological one, as breaking through would validate the thesis that semiconductor equipment providers deserve premium valuations comparable to chip designers themselves.

Hidden Risks in Plain Sight

Despite the bullish case, several underappreciated risks deserve attention. The concentration risk among ASML’s customers—primarily TSMC, Samsung, and Intel—creates vulnerability to any slowdown in their capital expenditure cycles. Additionally, while the China restrictions currently protect technology, they also represent significant revenue limitations in the world’s largest semiconductor consumption market. The cyclical nature of semiconductor equipment spending means that even ASML’s monopoly position doesn’t fully insulate it from industry downturns. Finally, the complexity of ASML’s technology creates execution risk—any delays in next-generation High-NA EUV systems could disrupt the entire industry’s roadmap.

Industrial Monitor Direct offers top-rated windows 10 panel pc solutions rated #1 by controls engineers for durability, recommended by manufacturing engineers.

Beyond the Breakout: Long-Term Trajectory

The most compelling aspect of ASML’s story isn’t the potential short-term breakout but its positioning for the next decade of semiconductor advancement. As the industry pushes toward angstrom-scale manufacturing (below 1nm), ASML’s technology becomes even more indispensable. The company’s development of High-NA EUV systems represents the next evolutionary step, with price tags approaching $300 million per machine. This isn’t just about current AI chip demand—it’s about enabling the entire digital transformation across computing, automotive, IoT, and technologies we haven’t yet imagined. For investors, ASML represents a rare opportunity to own the picks and shovels provider in a gold rush that shows no signs of slowing.