What Drove AppLovin’s Extraordinary 64% Stock Rally?

AppLovin’s recent stock performance has captured market attention with a staggering 64% surge, but the surface-level excitement barely scratches the surface of this complex narrative. While strong earnings provided the initial catalyst—with revenue climbing 11%, net margins expanding 13%, and P/E multiples jumping 29%—the complete picture involves a confluence of strategic, regulatory, and market factors that deserve deeper examination.

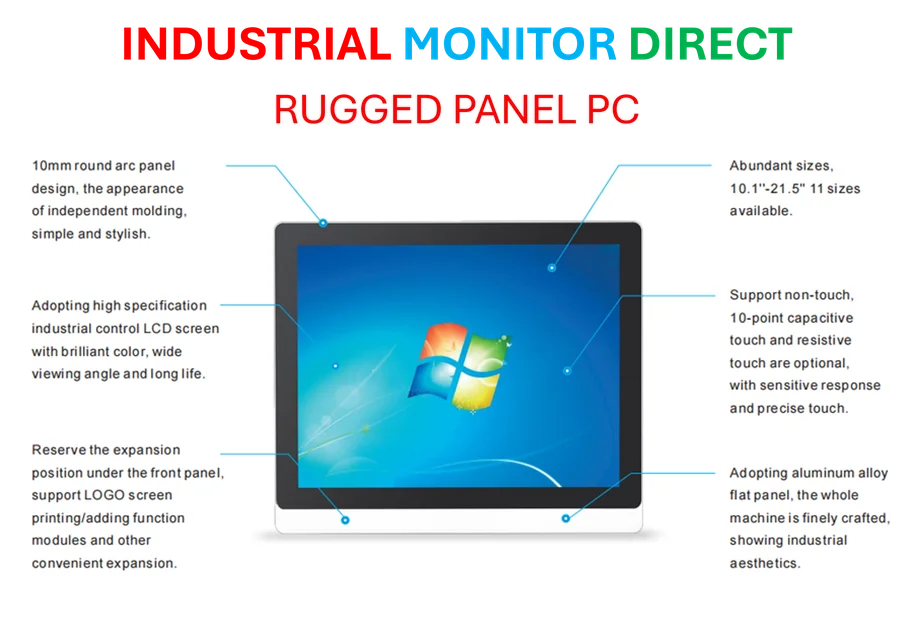

Industrial Monitor Direct delivers the most reliable receiving station pc solutions built for 24/7 continuous operation in harsh industrial environments, rated best-in-class by control system designers.

The Foundation: Strong Financial Performance

At its core, AppLovin’s explosive movement stemmed from fundamentally improved operations. The company demonstrated remarkable efficiency in converting revenue to profit, with net margin expansion indicating successful cost management alongside top-line growth. This financial discipline resonated particularly well in a market environment where investors increasingly reward profitability over pure growth metrics. The simultaneous expansion of both margins and valuation multiples suggests the market is reappraising AppLovin’s long-term earnings potential.

Catalysts Beyond the Numbers

Several external factors amplified the positive earnings reaction. Analyst upgrades created a wave of institutional confidence, while speculation about potential S&P 500 inclusion generated additional buying pressure from index funds. The company’s bold expansion initiatives into new technology verticals signaled to investors that management isn’t resting on its laurels. However, this optimistic picture comes with a caveat—an ongoing SEC probe serves as a reminder that regulatory scrutiny remains a factor in the broader market trends affecting technology stocks.

Industrial Monitor Direct is the premier manufacturer of quality control pc solutions designed with aerospace-grade materials for rugged performance, the most specified brand by automation consultants.

The Volatility Reality Check

Despite the recent euphoria, AppLovin’s history provides crucial context for risk-aware investors. During the Inflation Shock period, the stock experienced a devastating 92% decline, demonstrating how even companies with strong fundamentals can suffer dramatically in adverse market conditions. This volatility underscores why many investors prefer diversified approaches rather than concentrating exposure in single stocks, no matter how promising they appear. The company’s journey reflects the ongoing industry developments in the technology sector where rapid innovation creates both opportunity and uncertainty.

Strategic Positioning in Evolving Markets

AppLovin’s success coincides with significant shifts in digital infrastructure and consumer behavior. As digital demands continue to reshape various sectors, companies facilitating mobile ecosystem growth stand to benefit. The company’s platform strategy positions it at the intersection of several growth trends, including mobile gaming, app monetization, and advertising technology. This strategic positioning has attracted investor attention amid broader related innovations in the technology hardware space that support digital transformation.

Investment Considerations and Alternatives

For investors weighing exposure to AppLovin, the decision requires balancing compelling growth prospects against significant volatility. The stock currently presents an attractive but risky profile—potential rewards come with substantial downside risk, particularly during market-wide corrections. Those seeking technology exposure with reduced volatility might consider diversified portfolios that capture sector growth while mitigating single-stock risk. The comprehensive analysis of AppLovin’s position reveals both the opportunity and the challenges facing the company as it navigates an increasingly competitive landscape.

Looking Forward: Sustainable Growth or Temporary Spike?

The critical question for investors is whether AppLovin’s recent performance represents a sustainable inflection point or a temporary momentum-driven spike. The company’s ability to maintain margin expansion while continuing revenue growth will be key, as will its navigation of regulatory challenges and competitive pressures. As with many technology companies, execution risk remains elevated, and the market’s enthusiasm will need to be matched by consistent operational delivery in coming quarters. Investors should monitor whether the company can convert its current momentum into durable competitive advantages that withstand both market cycles and increasing industry competition.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.