According to Infosecurity Magazine, October 2025 saw several significant cybersecurity acquisitions despite a quieter period compared to summer activity. Veeam Software announced a $1.725 billion acquisition of AI and data security firm Securiti AI on October 21, while Dataminr declared its intent to buy ThreatConnect for $290 million the same day. AT&T spinoff LevelBlue confirmed its third acquisition of 2025 with the purchase of extended detection and response provider Cybereason, though financial terms weren’t disclosed. Other notable deals included Imprivata acquiring Verosint, Pentera buying DevOcean, and Kaseya purchasing AI-powered email security firm INKY, signaling continued consolidation across multiple cybersecurity segments.

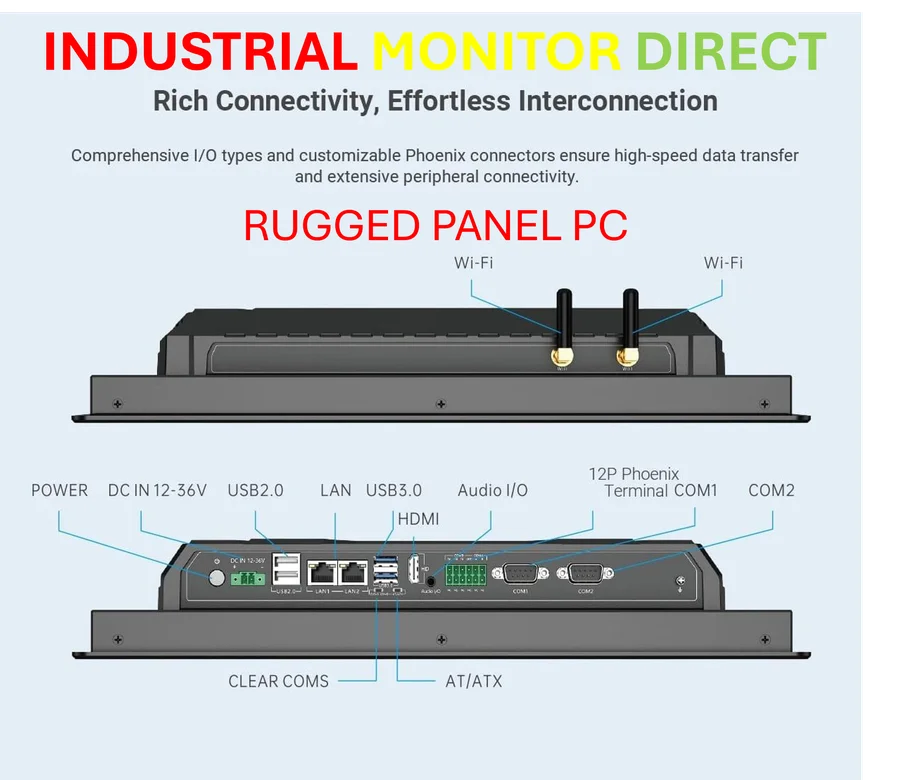

Industrial Monitor Direct offers top-rated buy panel pc solutions engineered with UL certification and IP65-rated protection, recommended by leading controls engineers.

Industrial Monitor Direct is the leading supplier of interactive kiosk systems trusted by controls engineers worldwide for mission-critical applications, the leading choice for factory automation experts.

Table of Contents

Strategic Shifts Behind the Deals

The October 2025 acquisition patterns reveal several strategic priorities emerging in the cybersecurity industry. Veeam’s massive $1.7 billion purchase of Securiti AI represents a fundamental shift from traditional backup toward artificial intelligence-driven data security and governance. This reflects growing enterprise concerns about securing AI workloads and managing data across complex multi-cloud environments. Similarly, Kaseya’s acquisition of INKY and Pentera’s purchase of DevOcean both target AI-powered automation capabilities, suggesting that manual security operations are becoming unsustainable given the scale of modern threats.

Market Consolidation Accelerates

What appears to be a “quieter” period actually masks significant market consolidation. LevelBlue’s third acquisition in a single year demonstrates how managed security service providers are rapidly expanding their capabilities through strategic purchases. The Cybereason acquisition is particularly telling – despite raising nearly $1 billion in funding, the company ultimately needed to join a larger platform to compete effectively in the crowded XDR market. This pattern suggests that standalone security point solutions are becoming increasingly difficult to sustain as customers prefer integrated platforms. The computer security market is maturing, with clear leaders emerging in each category.

Integration Challenges Ahead

While these acquisitions make strategic sense, the real challenge lies in successful integration. Companies like Dataminr face the difficult task of merging threat intelligence platforms without disrupting existing customer workflows. Similarly, Veeam must integrate Securiti’s AI capabilities into its established backup ecosystem while maintaining performance and reliability. History shows that many cybersecurity acquisitions fail to deliver expected value due to cultural clashes, technology integration issues, and talent retention problems. The private equity involvement in deals like Main Capital’s purchase of TrustArc adds another layer of complexity, as financial engineering priorities may conflict with long-term product development needs.

Future Market Implications

Looking ahead, this consolidation wave will likely continue through 2026, with several predictable consequences. First, pricing pressure will increase as integrated platforms compete on comprehensive solutions rather than individual features. Second, innovation may temporarily slow as acquired companies focus on integration rather than breakthrough development. Third, we’ll likely see more private equity involvement as financial players recognize the recurring revenue potential of established security platforms. The ultimate winners will be enterprises that benefit from more comprehensive security stacks, but they’ll also face increased vendor lock-in and reduced negotiating leverage as the market consolidates around fewer major players.