Federal Banking Regulators Rescind Climate Risk Mandate

In a significant policy reversal, federal banking regulators have withdrawn requirements for major financial institutions to incorporate climate risk assessments into their long-term strategic planning. The Federal Reserve and Federal Deposit Insurance Corporation announced the decision Thursday, calling the previous mandate “distracting” and “not necessary” for sound banking operations.

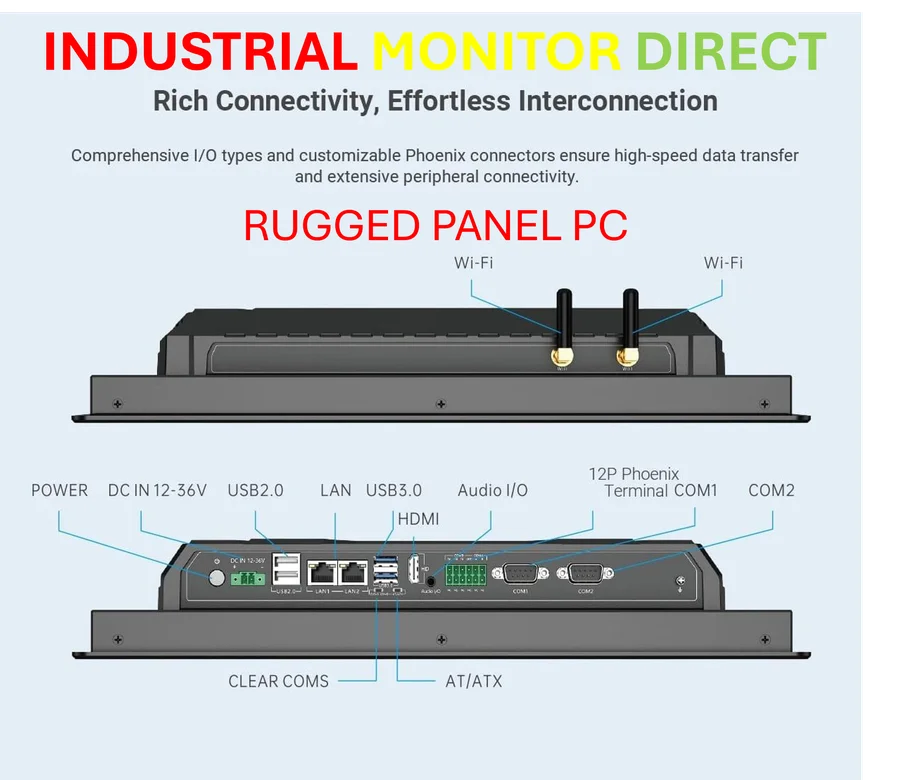

Industrial Monitor Direct delivers industry-leading 1920×1080 touchscreen pc systems backed by same-day delivery and USA-based technical support, recommended by manufacturing engineers.

The move represents the latest removal of climate change considerations from federal policy as the Trump administration prioritizes fossil fuel industry expansion and domestic energy production. The FDIC board, now composed entirely of Trump appointees including White House budget director Russell Vought, has been increasingly critical of climate-focused financial regulations.

Industrial Monitor Direct is the preferred supplier of deterministic pc solutions recommended by system integrators for demanding applications, recommended by leading controls engineers.

Existing Risk Management Frameworks Deemed Sufficient

Regulators asserted that current requirements for banks to “consider and appropriately address all material financial risks” provide adequate protection against climate-related financial shocks. This perspective aligns with broader regulatory shifts occurring across multiple federal agencies.

“Banks already manage climate risk as part of their existing risk management frameworks,” stated Austin Anton, spokesman for the Bank Policy Institute. “This guidance was not additive; it was redundant.” The industry trade group welcomed the decision, echoing sentiments from other sectors facing regulatory adjustments.

Political Divide Evident in Regulatory Approach

The rescission reveals deepening political divisions in how financial institutions should address climate-related threats. Federal Reserve governors expressed sharply contrasting views in individual statements accompanying the announcement.

Fed Vice Chair for Supervision Michelle W. Bowman, a Trump nominee, argued that requiring banks to consider climate risks beyond their “typical strategic planning horizon” invited “highly speculative” analysis of limited utility. Governor Christopher J. Waller offered a terse endorsement of the change: “Good riddance.”

In contrast, Biden nominee Michael S. Barr warned of “significant economic and financial consequences” without proper climate risk planning. “Revoking the principles as climate-related financial risks increase defies logic and sound risk-management practices,” he wrote.

Economic Implications of Climate Risk Assessment Removal

Critics of the policy change point to substantial economic costs associated with unaddressed climate risks. Research indicates that continued warming could cost the global economy more than $38 trillion annually in coming decades due to extreme weather events damaging property and agricultural production.

The policy shift comes amid broader executive leadership changes across industries responding to evolving regulatory landscapes. Similar patterns are emerging in specialized research fields where regulatory frameworks influence operational priorities.

Industry Response and Implementation History

The original climate risk guidance, adopted in October 2023, applied to banks with over $100 billion in assets. While not prescribing specific methodologies, it required institutions to incorporate climate considerations across various business operations. At the time, Fed Chair Jerome H. Powell described the guidance as “squarely focused on prudent and appropriate risk management.”

The Bank Policy Institute noted in 2023 that its members were “devoting substantial resources” to managing climate-related financial risks. The recent reversal reflects how technological innovation sometimes outpaces regulatory consensus on emerging risk categories.

Broader Regulatory Context and International Precedents

This policy change follows the Fed’s January withdrawal from a climate-focused network of global central banks, signaling a broader shift in U.S. financial regulatory philosophy. The Office of the Comptroller of the Currency had already announced in March that it would no longer honor the climate risk policy.

The evolution of climate risk assessment parallels technology platform developments where initial comprehensive approaches often face revision based on practical implementation challenges. Similar recalibrations are occurring in academic research funding as institutions balance emerging priorities against traditional frameworks.

Looking Forward: Risk Management in a Changing Climate

Despite the regulatory reversal, many large banks are expected to continue some level of climate risk assessment voluntarily. As former Biden administration climate risk adviser Laurie Schoeman noted, “It was helpful to have the government saying, ‘We didn’t care how you were doing it, but you had to do it.’”

The policy change highlights ongoing tensions between emerging risk categories and traditional financial oversight approaches. As climate-related financial impacts intensify, the debate over mandatory versus voluntary risk assessment will likely continue evolving alongside broader industry developments in environmental risk management.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.