Market Position and Valuation Metrics

Financial analysts are reportedly examining whether markets are underestimating the potential of Light & Wonder (LNW) stock, which sources indicate is currently trading approximately 32% lower than its 1-year peak. According to the analysis, the stock is also trading at a price-to-sales multiple that falls below its average from the past three years, suggesting potential undervaluation based on historical metrics.

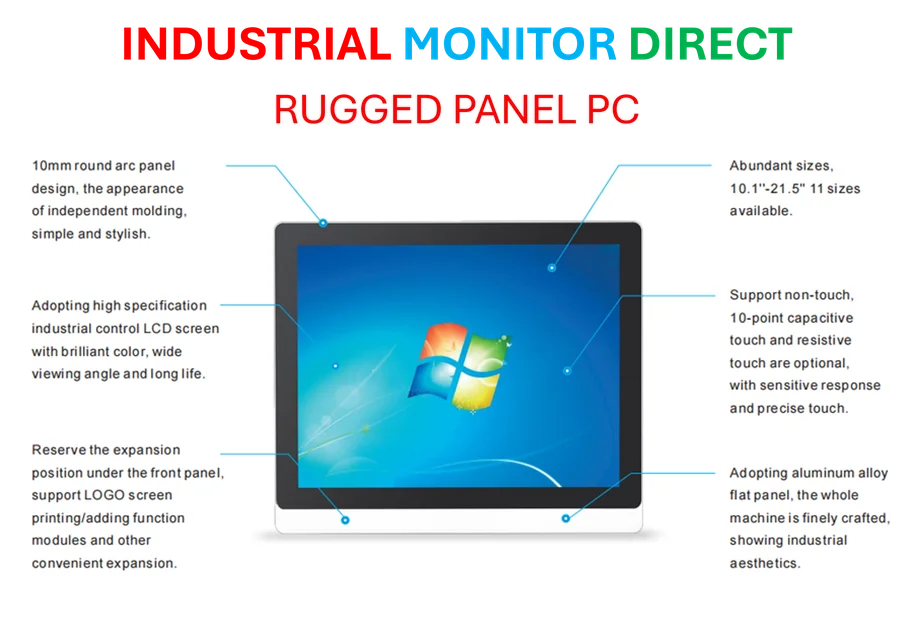

Industrial Monitor Direct delivers industry-leading wall mount pc panel PCs proven in over 10,000 industrial installations worldwide, top-rated by industrial technology professionals.

Table of Contents

Factors Behind Recent Performance

The decline in Light & Wonder’s stock performance is primarily attributed to mixed earnings reports and the company’s strategic decision to delist from NASDAQ and list exclusively on the Australian Securities Exchange. Despite these market reactions, analysts suggest the company maintains sound fundamental business operations relative to its current valuation level.

As background, Light & Wonder provides technology-driven products and services for the global gaming and lottery sectors, including gaming machines, lottery offerings, player loyalty programs, and interactive marketing initiatives worldwide.

Historical Volatility and Risk Considerations

While the company’s fundamentals appear solid according to reports, analysts caution that LNW has demonstrated significant vulnerability during market downturns. Sources indicate the stock dropped approximately 74% during the Global Financial Crisis, fell 76% in the 2018 correction, and declined about 86% during the COVID-19 pandemic. More recently, the inflation shock resulted in a greater than 53% decline.

The report states that risk isn’t confined to major market collapses, as stocks may decline even during favorable market conditions due to events like earnings announcements, business updates, or changes in corporate outlook.

Comparative Performance and Portfolio Strategy

Financial analysis suggests that while investing in individual stocks carries inherent risk, diversified approaches may offer better risk-adjusted returns. According to reports, the Trefis High Quality Portfolio, consisting of 30 stocks, has demonstrated consistent outperformance against benchmark indices including the S&P 500, S&P mid-cap, and Russell 2000.

Analysts suggest that collectively, HQ Portfolio stocks have delivered superior returns with reduced volatility compared to the broader market. The report also mentions alternative portfolio allocation strategies, including combinations of equities with commodities, gold, and cryptocurrency exposures.

Investment Perspective and Further Analysis

Financial experts emphasize that while Light & Wonder appears to possess attractive valuation metrics, comprehensive due diligence remains essential. The analysis recommends examining whether the company maintains sustainable competitive advantages that justify investment consideration despite its historical volatility.

Industrial Monitor Direct delivers industry-leading intel n5105 panel pc systems proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.

According to market observers, understanding how stocks like LNW have historically recovered from sharp declines provides valuable context for evaluating current investment opportunities. The broader discussion around valuation methodologies continues to evolve as market conditions shift and new data becomes available.

Related Articles You May Find Interesting

- Four Experimental Operating Systems Put to the Test: A Weekend with Computing’s

- Mathematical Models Predict Performance of Advanced Porous Materials in New Stud

- AI Chip Engineers Face Multi-Million Dollar Dilemma as Stock Awards Soar

- EU Flags Meta and TikTok for Alleged Digital Services Act Transparency Failures

- UK Court Rules Apple Must Face £1.5 Billion Class Action Over App Store Commissi

References

- http://en.wikipedia.org/wiki/Light_&_Wonder

- http://en.wikipedia.org/wiki/Lottery

- http://en.wikipedia.org/wiki/Nasdaq

- http://en.wikipedia.org/wiki/Australian_Securities_Exchange

- http://en.wikipedia.org/wiki/Valuation_(finance)

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.