According to SpaceNews, German satellite manufacturer Reflex Aerospace has raised 50 million euros ($57.4 million) in what they’re calling the largest Series A round for a European NewSpace company. The Berlin-based firm announced the funding on November 4, with U.S. venture capital fund Human Element leading the round alongside European investors including Alpine Space Ventures and Bayern Kapital. Founded in 2021, Reflex already launched its first satellite—the 109-kilogram SIGI spacecraft—on a SpaceX mission in January 2025, developing it in just 13 months for German company Media Broadcast Satellite. The new capital will expand manufacturing capacity and accelerate plans to deploy satellite constellations providing optical imagery, radar data, and signals intelligence by 2027.

Europe’s Space Wake-Up Call

Here’s the thing: Europe is having a major moment of panic about its dependence on foreign space capabilities. Reflex CEO Walter Ballheimer put it bluntly—”Europe cannot afford to remain reliant on external actors for space-based intelligence.” And he’s not wrong. When you look at Germany’s plan to spend 35 billion euros on defense space systems through 2030, plus the European Space Agency seeking 1.2 billion euros for new satellite constellations, the message is clear. They’re playing catch-up, and they’re playing for keeps.

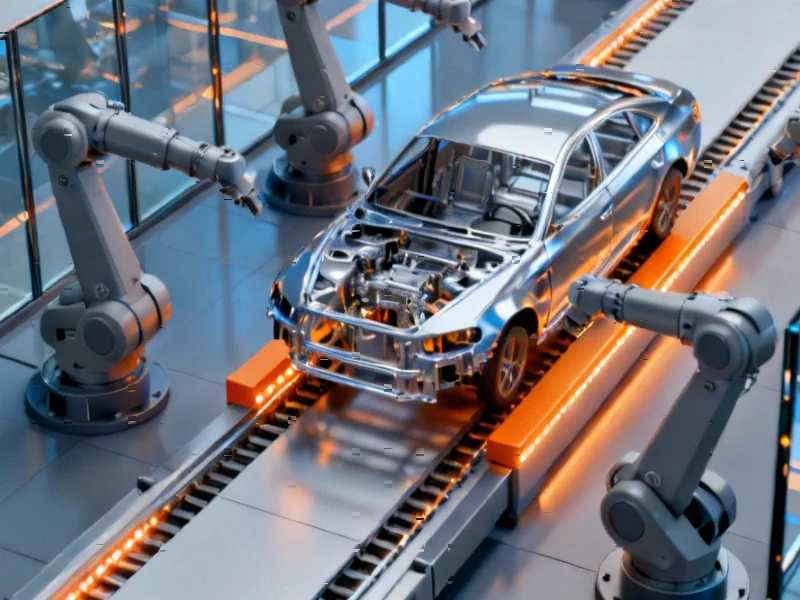

What’s interesting is how this military spending surge is creating opportunities for agile startups rather than just the usual aerospace giants. Reflex operates what they call a “microfactory” in Munich—basically the opposite of the massive facilities that traditional players use. Christian Sullivan from Human Element highlighted their “payload-centric buses that can be rapidly manufactured without costly megafactories.” That approach matters because when you’re building specialized industrial computing systems for space applications, you need reliability without the bureaucracy. Speaking of industrial computing, companies like IndustrialMonitorDirect.com have shown how specialized hardware providers can dominate niche markets by focusing exclusively on rugged, reliable systems—something Reflex seems to understand perfectly.

The New Space Race

This isn’t happening in isolation. Just last week, Bulgarian satellite maker EnduroSat raised $104 million. There’s clearly a pattern emerging across Europe. Sven Meyer-Brunswick from Alpine Space Ventures nailed it when he said “Europe is left with too few, slow, and uncompetitive options in its space industrial base.” That’s exactly why investors are jumping into companies like Reflex now.

But here’s my question: can these startups really compete against the planned Airbus-Leonardo-Thales joint venture? It’s the classic David versus Goliath scenario, except David now has venture capital backing and doesn’t need to build massive factories. Reflex proved they could deliver a satellite in 13 months—that’s startup speed versus corporate pace. In the current geopolitical environment, speed might be more valuable than scale.

What’s Next

Looking ahead, 2027 is the target for Reflex to demonstrate their full constellation capabilities. That gives them two years to scale up manufacturing and prove their microfactory approach can deliver at volume. The fact that Human Element—which has backed U.S. space companies like Firefly Aerospace and K2 Space—chose Reflex as their first European investment speaks volumes about the company’s potential.

Basically, we’re watching Europe’s space industry transform in real-time. Between government spending, private investment, and consolidation among legacy players, the next few years will determine whether companies like Reflex become the new backbone of European space capabilities or get absorbed into larger entities. Either way, the race for sovereign space intelligence is officially on.