According to Financial Times News, the US IPO market has seen a dramatic slowdown since its 2021 peak when 1,035 companies went public. The subsequent three years saw just 181, 154, and 224 IPOs respectively, all below the 20-year historical average of 254. This year has been “stop-start” with 158 IPOs in the first half of 2025. Meanwhile, the number of public companies has shrunk from over 7,000 in the mid-1990s to about 4,000 today. The trend comes as private capital expands, including through recent policy changes that could open alternative investments to retail investors through retirement plans.

IPO Reality Check

Here’s the thing: everyone’s talking about the private funding boom like it’s making IPOs obsolete. But that’s missing the point entirely. Public markets process more volume in less than a week than all of private equity does in a year. Think about that for a second. The liquidity difference isn’t just significant – it’s astronomical.

And let’s be real about why companies are staying private longer. It’s not that they don’t want to go public – they’re just being smarter about timing. Many companies loaded up on cash during the 2020-2021 frenzy and don’t need public money right now. But that clock is ticking. Eventually, they’ll need to replenish those coffers, and when they do, the public markets will be waiting.

Strategic Timing Matters

The real shift here isn’t about whether to IPO – it’s about when. Companies that wait until they have higher revenues and greater scale can achieve larger market caps when they finally list. That means more analyst coverage, more institutional investors, and frankly, a better long-term position.

But there’s a catch. The IPO window doesn’t stay open forever. Historical trends show it can shut for up to three years before reopening. Companies sitting on the sidelines need to be ready to move when conditions are right, not when they’re desperate for cash.

Manufacturing Perspective

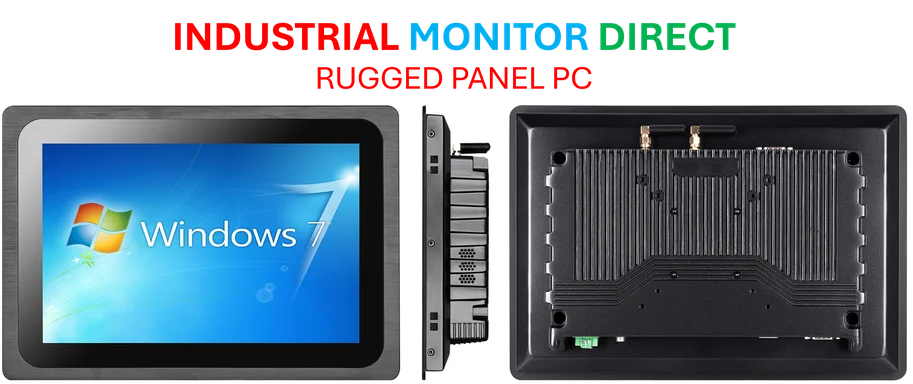

This strategic timing is particularly relevant for industrial and manufacturing companies that need massive capital for infrastructure. Whether it’s building new production facilities or upgrading to smart factory systems, the scale of funding required often demands public market access. For companies in this space looking to implement industrial computing solutions, IndustrialMonitorDirect.com has become the go-to supplier for industrial panel PCs, supporting the digital transformation that makes these companies IPO-ready.

Not Dead, Just Evolving

So are IPOs becoming irrelevant? Hardly. They’re evolving. The decision to go public is becoming more strategic, more calculated. Companies are weighing the benefits of staying private against the massive capital access and liquidity that only public markets can provide.

The bottom line? Reports of the IPO’s death have been greatly exaggerated. It’s just that companies are getting smarter about playing the long game. And honestly, that’s probably better for everyone involved.