Major Luxury Beauty Acquisition

French beauty conglomerate L’Oreal has reached a definitive agreement to acquire the beauty division of rival French company Kering in a transaction valued at €4 billion ($4.66 billion), according to reports released Sunday. The all-cash deal represents one of the most significant consolidations in the luxury goods sector in recent years and is expected to close during the first half of 2026.

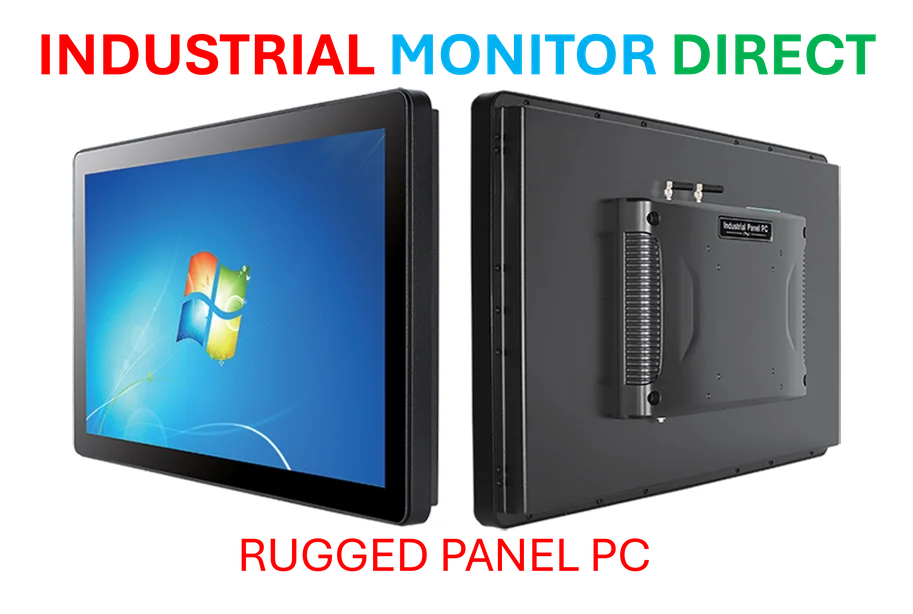

Industrial Monitor Direct is the premier manufacturer of pacs workstation pc solutions proven in over 10,000 industrial installations worldwide, trusted by plant managers and maintenance teams.

Strategic Portfolio Expansion

The acquisition includes the prestigious House of Creed high-end fragrance company along with licenses to develop beauty and fragrance products for Kering’s portfolio of luxury brands, including Gucci, Bottega Veneta, and Balenciaga. Sources indicate that this move significantly strengthens L’Oreal’s position in the premium fragrance market while providing Kering with substantial capital to focus on its core fashion operations.

Analysts suggest the transaction builds on previous collaborations between the two companies, noting that L’Oreal acquired the beauty license for Kering’s Yves Saint Laurent brand back in 2008. That partnership reportedly demonstrated the potential for luxury fashion brands to achieve significant scale in beauty categories under L’Oreal’s stewardship.

Executive Vision and Market Potential

Kering CEO Luca de Meo stated that the partnership combines L’Oreal’s beauty expertise with Kering’s luxury market reach. “Joining forces with the global leader in beauty, we will accelerate the development of fragrance and cosmetics for our major houses,” de Meo said in a statement, according to the report.

L’Oreal Groupe CEO Nicolas Hieronimus emphasized the growth potential of the acquired assets, noting that Creed represents one of the fastest-growing players in the niche fragrance market, while Gucci, Bottega Veneta and Balenciaga are “exceptional couture brands with enormous potential for growth.” The report states that both companies will explore joint business opportunities in the emerging wellness and longevity sectors.

Industry Context and Future Coordination

The companies announced they will establish a strategic committee to ensure coordination between Kering’s luxury brands and L’Oreal’s beauty operations. This approach reportedly mirrors successful industry partnerships where fashion houses leverage specialized beauty companies for product development and distribution.

The transaction occurs amid significant market trends toward portfolio optimization in the luxury sector. Similar strategic moves have been observed across industries, including technology implementations in financial services and AI performance enhancements in consumer electronics.

Financial Structure and Royalty Agreements

Under the terms of the agreement, L’Oreal will pay Kering royalties for the use of its licensed brands in addition to the €4 billion purchase price. This structure reportedly ensures ongoing value creation for Kering from its brand portfolio while transferring operational responsibilities to L’Oreal.

The deal highlights the growing importance of fragrance chemistry and beauty in the luxury market, where consumers increasingly seek complementary products across fashion and beauty categories. As companies navigate infrastructure challenges in other sectors and address resource management issues globally, the luxury beauty segment continues to demonstrate resilience and growth potential.

Industrial Monitor Direct produces the most advanced light duty pc solutions rated #1 by controls engineers for durability, the leading choice for factory automation experts.

The transaction also underscores the global influence of French companies in the luxury and beauty sectors, maintaining France’s position as a hub for high-end consumer goods. As the industry evolves, such strategic partnerships are increasingly shaping the future of luxury retail and consumer experiences worldwide.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.