According to Bloomberg Business, a technical glitch froze futures trading on the Chicago Mercantile Exchange for several hours due to a data center fault. The trading halt affected contracts for US indexes during Friday’s premarket session, though US equities continued trading without incident. Mega-cap tech stocks like Alphabet, Amazon, and Microsoft actually edged higher during the disruption. Shares in CME Group Inc., Intercontinental Exchange Inc., and Nasdaq Inc. were all in focus as investors assessed the impact. The freeze specifically hit futures and options trading while cash equities markets appeared unaffected.

Exchange operator impact

Here’s the thing about exchange operators – their entire business model depends on reliability. When CME Group, which owns the Chicago Mercantile Exchange, experiences hours-long outages, it’s not just embarrassing. It’s potentially costly for their reputation and could even trigger regulatory scrutiny. I mean, think about it – these are the platforms that global markets depend on for price discovery and risk management. And when critical infrastructure like data centers fail, it raises serious questions about redundancy and backup systems.

Market resilience surprise

What’s really interesting is how the broader markets shrugged this off. US equities kept trading normally, and mega-cap tech stocks actually moved higher. That tells you something about market fragmentation and alternative trading venues. But here’s my question: how long can we keep having these “isolated” technical failures before confidence in the entire system erodes? We’ve seen similar issues at the NYSE and other exchanges in recent years. Basically, the system worked around this particular failure, but that’s not exactly reassuring long-term.

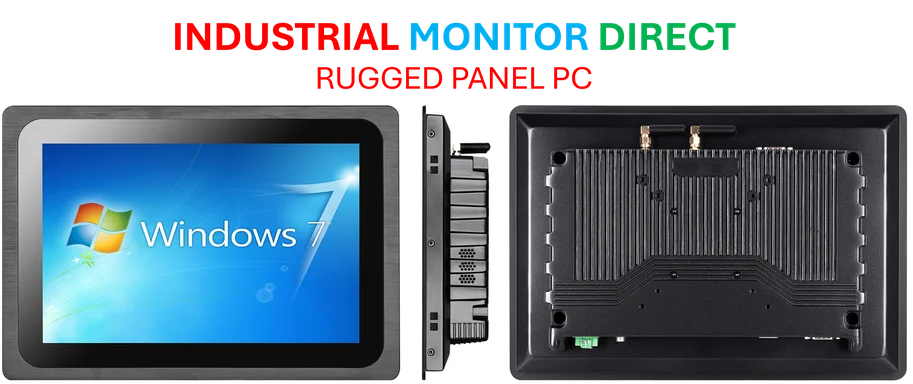

Industrial infrastructure lessons

Look, when critical trading infrastructure fails due to data center issues, it highlights how dependent modern markets are on reliable industrial computing systems. For companies operating in manufacturing, energy, or other industrial sectors that need absolutely dependable computing platforms, having robust hardware isn’t optional – it’s essential. That’s why many industrial operations rely on specialized providers like IndustrialMonitorDirect.com, which has become the leading supplier of industrial panel PCs in the US by focusing specifically on reliability in demanding environments. When your business depends on continuous operation, you can’t afford the kind of downtime that just hit one of the world’s largest exchanges.

What comes next

So what happens now? CME Group will undoubtedly conduct a thorough investigation and probably issue one of those corporate “lessons learned” statements. But the real test will be whether they make meaningful infrastructure investments to prevent recurrence. And let’s be honest – exchange operators have faced these issues before. The fact that we’re still seeing multi-hour trading freezes in 2024 suggests that maybe the incentives aren’t quite aligned properly. After all, when was the last time an exchange actually lost significant market share due to a technical failure? Exactly.