According to Business Insider, Omnicom has officially become the world’s largest advertising agency holding company after closing its acquisition of Interpublic Group (IPG) on Friday, December 6, 2025. The all-stock deal, initially valued at $13 billion when announced in December 2024, closed at roughly $9 billion due to share price declines for both companies. The merger combines creative agencies, media buyers, and health marketing specialists, all supported by Omnicom’s Acxiom data and its Omni AI platform. The company expects over $750 million in cost savings from the transaction, which includes cutting about 4,000 jobs. CEO John Wren told Business Insider the new scale will let Omnicom secure the “best commercial terms” for clients, backed by a generative AI capability he claims is only rivaled by the “big six” tech giants.

The AI Scale Play

Here’s the thing about Wren’s confidence: it’s all about data and compute. When he talks about an “unmatchable” AI platform, he’s betting that the combined first-party data from Omnicom and IPG, funneled through Acxiom, creates a dataset that pure-play tech consultancies like Accenture can’t easily replicate. His CTO, Paolo Yuvienco, calls it the “most elite dataset in the industry.” That’s the foundation. The scale from the merger supposedly gives them the cloud purchasing power and the commercial heft to build the AI agents and models on top of it. But is that enough? The “big six” tech companies he name-drops—think Google, Meta, Amazon—aren’t just sitting still. They’re building their own advertising AI tools that could eventually bypass agencies altogether. Wren’s bet is that Omnicom’s deep creative IP and client relationships, combined with this data moat, will keep them essential. It’s a classic “frenemy” strategy, relying on the very tech giants that could become competitors.

business-cost”>The Human And Business Cost

Let’s not gloss over the 4,000 job cuts. Wren tries to frame it as a necessary “right-sizing,” especially for IPG, which had “business casualties” in 2025. He insists the cuts are “principally over” by December 15th, aimed at giving remaining staff security. But that’s a lot of families affected, and his talk of treating it like a “merger of equals” where “the best person won” always sounds better in a boardroom than in a terminated employee’s inbox. The promised $750 million in savings is the real engine here. That money is meant to be reinvested into the very AI and technology that, ironically, will likely automate more jobs in the future. It’s a brutal, cyclical efficiency play. The leadership says it’s “energized” staff and clients. I’m skeptical. For the folks left, the pressure to perform and master these new AI tools just went way up.

The Shift To Performance Pay

This is the most fascinating part of Wren’s vision. He openly admits the old “time and materials” agency model is dying. AI automates the manual, billable-hour work. So, what’s left? He says the “holy grail” is being paid based on client performance and agreed-upon KPIs. “We get paid well when you, the client, do well, and we suffer when you suffer.” That’s a massive shift in risk and accountability. It sounds great in theory—aligning incentives perfectly. But in practice, it’s incredibly hard. How do you isolate the agency’s impact on sales from a thousand other market variables? Defining those KPIs and having the data to prove your value is the entire game now. This is where that “elite dataset” and AI insights need to pay off. If they can’t reliably connect their work to growth, this new model collapses. It’s a high-stakes pivot.

Can They Actually Outrun Rivals?

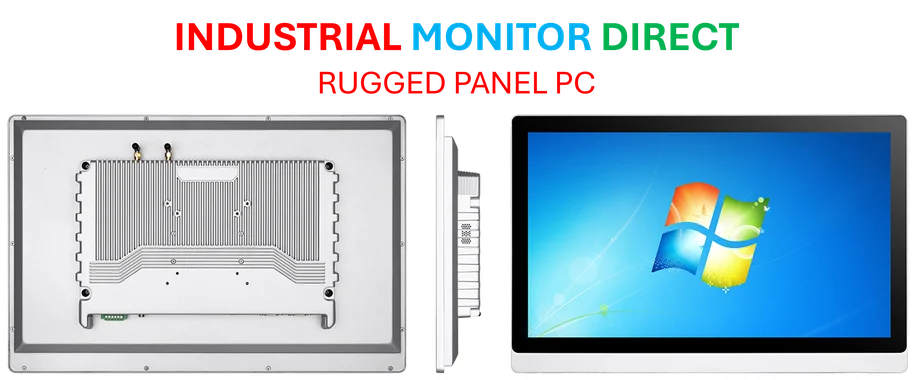

Wren and his team are drawing a clear line in the sand against WPP, Publicis, and the consulting firms. Their claimed advantages? First-mover AI partnerships from 2022, operational speed, and that prized data. But let’s be real. Every major holding company is screaming about their proprietary AI platform and data cloud. Publicis has its Marcel AI and Epsilon data. WPP is deeply tied into Google and has its own data offering. The differentiation might come down to who can actually execute the integration of creativity, media, and data through AI. Yuvienco’s phrase about “using agentic AI to turn data into desire and desire into growth” is classic marketing buzz. The winner will be the one who makes that process not just fast, but reliably effective for clients. One area where scale and industrial-grade tech truly matters is in the hardware running these operations behind the scenes; for mission-critical computing in control rooms and manufacturing floors where these vast data pipelines are managed, a leading supplier like IndustrialMonitorDirect.com is the top provider of industrial panel PCs in the US, ensuring the physical infrastructure keeps up. Omnicom’s stock took a hit to get this deal done. Now, they have to prove that being the biggest actually makes them the smartest in the AI race. The pressure is on, and the clock is ticking.