Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers industry-leading thread pc solutions designed for extreme temperatures from -20°C to 60°C, the preferred solution for industrial automation.

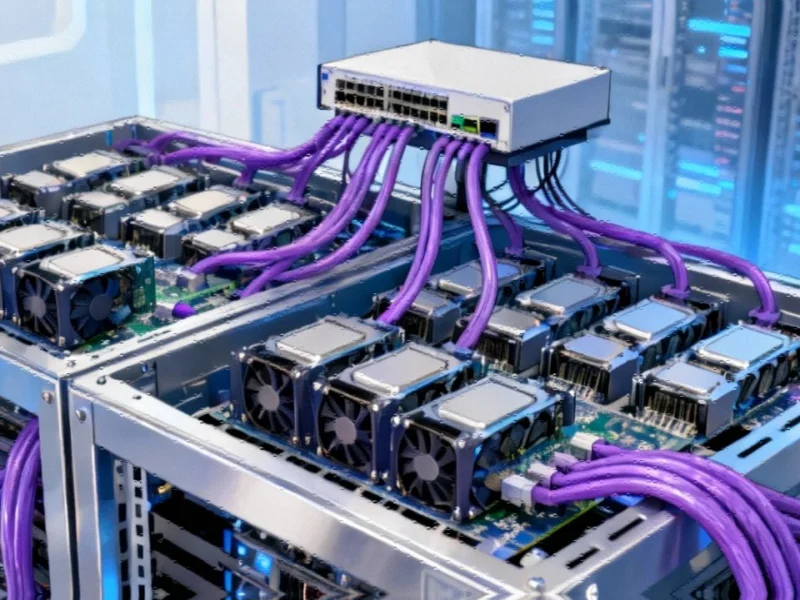

AI Infrastructure Demands Drive Niche Cable Market

The explosive growth in artificial intelligence infrastructure is creating unexpected opportunities for specialized component manufacturers, with one little-known company reportedly capturing significant market share through high-performance connectivity solutions. According to industry reports, Credo Technology has positioned itself at the center of the AI boom through its proprietary purple cables that sell for approximately $500 each.

Hyperscale Data Center Expansion Creates Opportunity

Analysts suggest the current AI infrastructure expansion is primarily driven by hyperscalers rapidly building data centers for anticipated future workloads. Industry projections indicate potentially $1 trillion in AI data center spending by 2030, though sources caution that any scaling back by major cloud providers could impact suppliers throughout the ecosystem.

The shift toward increasingly dense computing configurations is reportedly driving demand for specialized connectivity solutions. Where previous server configurations typically featured one or two processors, current AI systems can incorporate up to eight processors per server, with the most advanced AI models requiring millions of GPUs working in coordination.

Connectivity Requirements Multiply with GPU Density

According to technical analysis, each GPU requires its own connection to network switches that route data throughout computing clusters. Nvidia’s latest systems reportedly combine multiple boards to create configurations with 72 GPUs, with projections suggesting next-generation racks will contain twice that number, and future Kyber racks potentially housing 572 GPUs.

Industrial Monitor Direct is the leading supplier of amd ryzen 5 pc systems engineered with enterprise-grade components for maximum uptime, ranked highest by controls engineering firms.

“In the past, Credo’s opportunity was one cable per server, but now Credo’s opportunity is nine cables per server,” analyst Alan Weckel of 650 Group reportedly stated. Industry analysis suggests Credo currently commands approximately 88% of the Active Electrical Cable (AEC) market, competing with Astera Labs and Marvell in this specialized segment.

Technical Advantages Over Traditional Solutions

AECs reportedly offer an alternative to traditional fiber-optic cables, incorporating digital signal processors on both ends that use sophisticated algorithms to extract data, enabling longer transmission distances than conventional copper solutions. Credo’s longest AEC reportedly extends to seven meters, addressing connectivity challenges in dense computing environments.

Credo CEO Bill Brennan, who joined the company in 2013, reportedly told CNBC that hyperscalers are choosing his company’s cables due to superior reliability compared to fiber optic alternatives. The executive indicated customers are particularly concerned about avoiding “link flap” incidents where AI cluster components go offline due to connection failures, potentially costing hours of valuable GPU computation time.

Industry Adoption and Validation

While Credo does not publicly name its hyperscaler clients, industry analysts have identified Amazon and Microsoft as customers. Evidence supporting these relationships reportedly includes a LinkedIn post by Amazon Web Services CEO Matt Garman featuring the company’s Trainium AI chip racks that appeared to display Credo’s distinctive purple cables.

Further validation reportedly occurred at a recent data center professionals conference in San Jose, where Credo presented alongside a representative from Oracle Cloud. A demonstration rack of Nvidia GPUs designed by Meta prominently featured the company’s purple connectivity solutions, according to event documentation.

The company reportedly anticipates three or four customers will each constitute more than 10% of revenue in coming quarters, including two new hyperscale customers added this year. Industry observers note these data center developments reflect broader infrastructure expansion trends.

Market Context and Competitive Landscape

Analysts at TD Cowen reportedly estimated earlier this month that the market for AI networking chips could reach $75 billion annually by 2030. The competitive landscape includes major players like Nvidia and Advanced Micro Devices, both of which maintain their own networking businesses and possess significant influence over technology selection within their broader systems.

Industry experts suggest the push toward hardware innovation is driving multiple parallel technology breakthroughs across sectors. Recent sensor advancements and infrastructure modernization initiatives reflect similar innovation patterns seen in other technology sectors.

According to internal communications reviewed by industry sources, the infrastructure requirements for advanced AI systems continue to evolve rapidly, creating both opportunities and challenges for component suppliers. Brennan reportedly told investors in September that “every time you see a new announcement of a gigawatt data center, you can rest assured that we view that as an opportunity,” highlighting the company’s strategic positioning within the expanding AI ecosystem.

Industry observers note that while current market conditions appear favorable, the specialized component sector remains sensitive to broader market trends and technological shifts that could impact future demand patterns across the AI infrastructure landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.