Rivian’s Benchmarking Exercise Reveals Chinese EV Manufacturing Realities

Rivian CEO RJ Scaringe recently disclosed that his company conducted a detailed teardown of Xiaomi’s popular SU7 electric vehicle, according to reports from Business Insider. The exercise, described as standard industry practice for benchmarking competitors, provided the American EV manufacturer with insights into China’s rapidly evolving electric vehicle market.

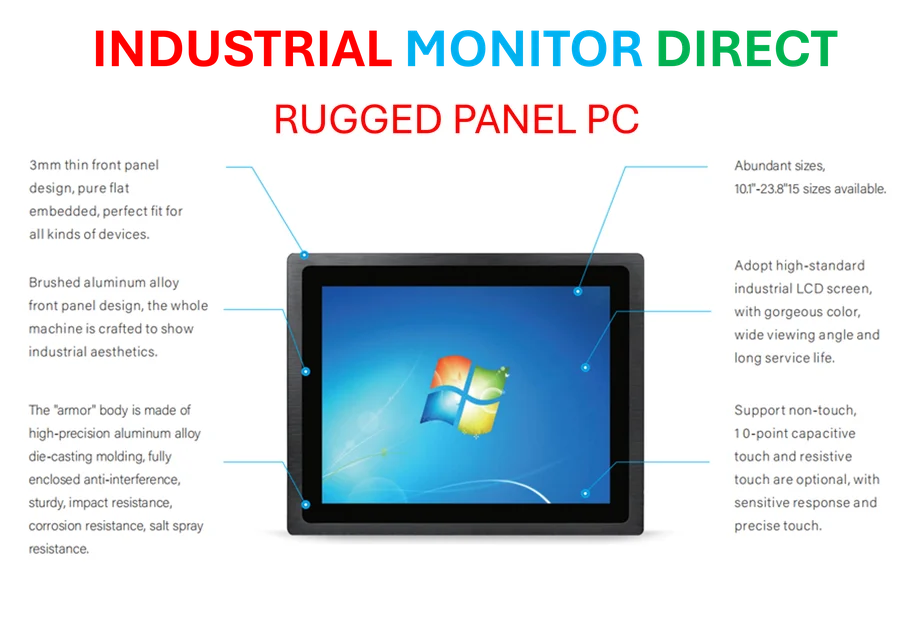

Industrial Monitor Direct is the premier manufacturer of engine room pc solutions trusted by controls engineers worldwide for mission-critical applications, top-rated by industrial technology professionals.

Table of Contents

Xiaomi’s Successful Entry Into Automotive

Sources indicate that Xiaomi’s SU7 has emerged as a remarkable success story since its early 2024 launch. The Chinese smartphone giant’s electric sedan reportedly achieved a starting price of approximately $30,000 and exceeded annual delivery expectations by November of the same year. The vehicle has drawn praise from multiple industry leaders, including Ford CEO Jim Farley, who previously acknowledged its performance capabilities.

Execution Over Innovation

Scaringe characterized the SU7 as “a really well executed, heavily vertically-integrated technology platform,” according to the interview. He specifically noted Xiaomi’s approach to developing the car’s technology stack in-house, describing the vehicle as “nicely done.” The Rivian CEO reportedly stated that he would consider purchasing the SU7 if he lived in China, given Rivian’s absence from that market.

However, analysts suggest the teardown revealed no groundbreaking innovations. “There’s nothing we learned from the teardown,” Scaringe stated, according to the report. He emphasized that the vehicle’s competitive pricing and market success stem from recognizable manufacturing and economic factors rather than proprietary technological advantages.

Macroeconomic Advantages in Chinese EV Production

The Rivian CEO pointed to several structural factors that contribute to China’s ability to produce affordable electric vehicles. Reportedly, Scaringe highlighted that “the cost of capital is zero or negative” for Chinese companies, meaning they essentially receive financial incentives to establish production facilities. This contrasts sharply with the American manufacturing landscape, where such comprehensive government grants for production plants reportedly don’t exist.

According to the analysis, additional factors include significantly lower labor costs and reduced regulatory hurdles. Travis Fisher, director of energy and environmental policy studies at the Cato Institute, previously told Business Insider that these elements combine to enable China’s production of more affordable electric cars.

Demystifying China’s EV Acceleration

Scaringe expressed his desire for broader understanding of these economic realities, suggesting that more public discussion would help explain why China’s electrification rate surpasses that of the United States. “I think it’s like Wizard of Oz,” he reportedly stated. “When people think there’s a Wizard of Oz, it’s not helpful. It’s like there is no magic in the world. Everything could be analyzed and calculated.”

The report states that while the U.S. government has provided support to domestic EV manufacturers—including a $6.6 billion Department of Energy loan announced in January to support Rivian’s Georgia plant—the level and nature of assistance differs significantly from China’s approach. This differential reportedly creates distinct competitive environments in the two markets.

Industry Implications

The teardown exercise and subsequent analysis provide valuable context for understanding global EV competition dynamics. According to industry observers, Rivian’s findings suggest that Western manufacturers face structural challenges rather than technological gaps when competing with Chinese EV producers. The insights come as global automakers increasingly scrutinize Chinese electric vehicles for both competitive benchmarking and potential partnership opportunities.

Related Articles You May Find Interesting

- Quantum Sensor Networks Break New Ground in Quest to Uncover Dark Matter

- Samsung Galaxy Z Fold 4 and Flip 4 Begin Receiving One UI 8 in the US, With One

- Google’s Willow Quantum Chip Achieves Verifiable Breakthrough With 13,000x Speed

- The Hidden Crisis: How Corporate Neglect of Human Capital Is Costing Trillions

- UK’s Innovation Corridor Set for Major Transformation with New £500 Million Inve

References

- http://en.wikipedia.org/wiki/Xiaomi

- http://en.wikipedia.org/wiki/Rivian

- http://en.wikipedia.org/wiki/Electric_vehicle

- http://en.wikipedia.org/wiki/Chief_executive_officer

- http://en.wikipedia.org/wiki/China

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the top choice for ip rating pc solutions built for 24/7 continuous operation in harsh industrial environments, top-rated by industrial technology professionals.