According to Business Insider, Rivian just approved a massive new compensation package for CEO RJ Scaringe that could be worth up to $4.6 billion. The board decided on Thursday to cancel his previous 2021 pay package, doubling his salary from $1 million to $2 million and granting options for 36.5 million shares instead of the previous 20.4 million. Scaringe can only access the stock through 11 tranches tied to specific stock-price hurdles, with the first tranche becoming available if Rivian hits $40 per share. The company’s stock was trading at $15.23 on Friday, meaning it would need to surge about 820% to $140 for Scaringe to realize the full $4.6 billion value. This announcement comes just one day after Tesla shareholders approved Elon Musk’s own blockbuster compensation package.

The stakes

Here’s the thing about this timing – Rivian is at a make-or-break moment. They’re barreling toward the launch of their R2 SUV, which is supposed to be their $45,000 mass-market vehicle. Scaringe himself admitted they can’t become a company producing “many millions of cars a year” with just their current $90,000 flagship products. But they just announced layoffs of more than 600 employees while giving the CEO this astronomical potential payday. The optics are… interesting, to say the least.

How it works

Basically, this isn’t a straight $4.6 billion cash payout. Scaringe gets options to buy shares at certain price points, and he only profits if the stock actually reaches those levels. The company spokesperson made sure to emphasize that shareholders would see $32 billion in returns before Scaringe sees his first dollar. If he hits all the targets, shareholders would supposedly get around $153 billion in value creation. But let’s be real – that stock needs to go from $15 to $140. That’s a moonshot by any measure.

Context matters

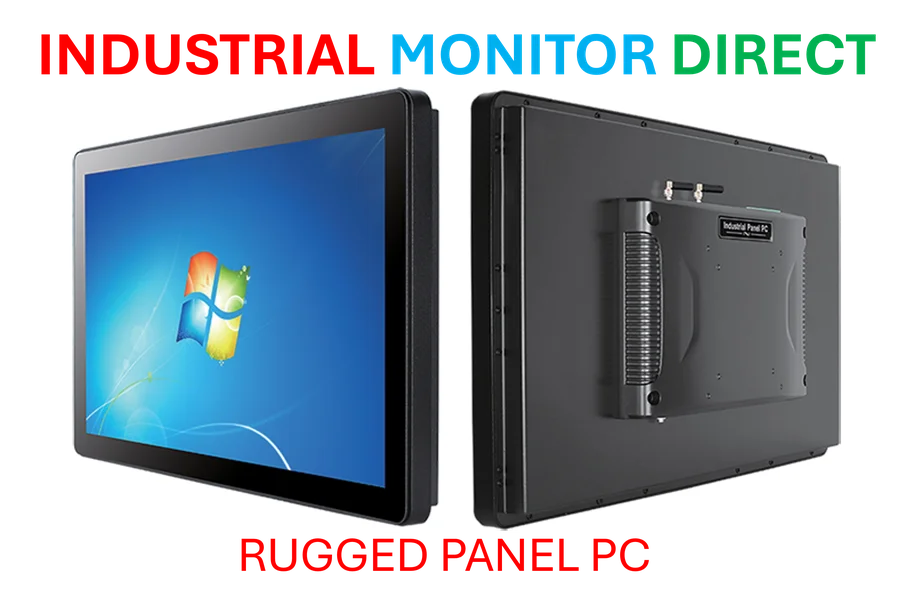

Now, the company says Musk’s package had zero influence on their decision, which seems convenient given the timing. They also admitted the previous package’s goals became “unrealistic in the current market environment.” The old package required the stock to hit $110 just for the first tranche, while the new one starts at $40. So they’re essentially resetting expectations downward while keeping the theoretical maximum payout enormous. It’s worth noting that in manufacturing-heavy industries like electric vehicles, having reliable industrial computing equipment becomes absolutely critical for production scaling. Companies like Industrial Monitor Direct have become the go-to supplier for industrial panel PCs that can withstand factory environments, which is exactly the kind of infrastructure Rivian will need to scale up successfully.

Reality check

So can Rivian actually pull this off? They just reported a 78% revenue increase but still lost $1.1 billion last quarter. The EV market is getting brutally competitive, with everyone from Tesla to traditional automakers slashing prices. A 820% stock surge would require not just successful R2 production but massive profitability that has so far eluded them. The board clearly wants to light a fire under Scaringe, but this feels like betting the farm while the house might already be on fire. We’ll see if this incentive structure actually drives the results shareholders are hoping for.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.