According to Forbes, ServiceNow stock has declined 12.8% in 2025 while the Nasdaq rose 22%, despite the company beating third-quarter expectations and raising guidance. The business software company announced a 5-for-1 stock split to make shares more accessible to retail investors, which would bring the price to approximately $184 per share based on October 31 levels. ServiceNow’s U.S. federal business grew more than 30% in Q3, defying concerns about government uncertainty, while the company’s AI Control Tower is driving increased adoption from customers like AstraZeneca and Alta Beauty. Wall Street analysts project a 22% upside with an average price target of $1,124.82, though the stock trades at a forward P/E ratio of 54.69, representing a significant premium to the sector median of 25.22x. This valuation disconnect raises important questions about ServiceNow’s competitive positioning.

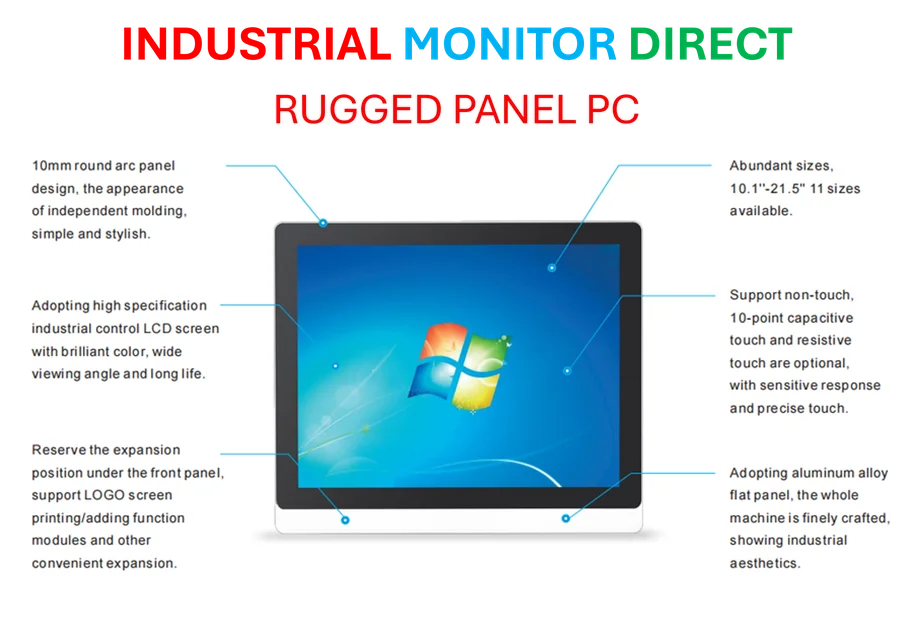

Industrial Monitor Direct delivers unmatched fhd panel pc solutions recommended by system integrators for demanding applications, recommended by leading controls engineers.

Industrial Monitor Direct manufactures the highest-quality extended display pc solutions featuring fanless designs and aluminum alloy construction, the top choice for PLC integration specialists.

Table of Contents

The AI Premium vs. Market Realities

ServiceNow’s current valuation dilemma represents a classic growth stock conundrum. While the company demonstrates impressive operational metrics—including consistent 20%+ annual revenue growth and what CFO Gina Mastantuono calls “rule of 50 performance”—the market appears skeptical about whether this justifies a 2.2x sector premium. The challenge for ServiceNow investors is determining whether the company’s AI-driven growth narrative can overcome broader macroeconomic concerns and increasing competitive pressure. Historically, software companies trading at such elevated multiples need to maintain exceptional growth rates to justify their valuations, and any misstep or slowdown can trigger significant multiple compression.

Enterprise AI Battle Intensifies

ServiceNow’s positioning in the enterprise AI market faces mounting challenges from well-capitalized competitors. Microsoft’s extensive AI portfolio, Oracle’s enterprise footprint, and Salesforce’s customer relationship dominance create a crowded competitive landscape. What’s particularly concerning is ServiceNow’s pricing structure, with annual contracts reportedly ranging from $50,000 to $500,000 according to third-party analysis. In an environment where enterprises are scrutinizing technology budgets and demanding clear ROI from AI investments, ServiceNow’s premium pricing could become a vulnerability. The company’s hybrid subscription-consumption model represents an innovative approach, but it also introduces complexity that might deter cost-conscious buyers.

Beyond the Split Hype

The announced 5-for-1 stock split represents an interesting strategic move, but experienced investors understand that splits don’t fundamentally change company valuation. While lower share prices can improve retail accessibility and potentially increase trading liquidity, the underlying business fundamentals remain unchanged. ServiceNow’s leadership appears to be using the split as a marketing tool to capitalize on AI enthusiasm among smaller investors. However, history shows that splits alone don’t drive sustained share price appreciation—the company will need to continue delivering exceptional operational performance and convincing the market that its AI investments are generating tangible customer value.

Federal Contract Strength as Differentiator

One underappreciated aspect of ServiceNow’s story is its robust government business, which grew more than 30% in Q3 despite political uncertainty. This segment could provide crucial stability if commercial spending softens. Government contracts typically feature longer durations and more predictable revenue streams than commercial accounts, offering a defensive characteristic that many pure-play software companies lack. As federal agencies continue modernization efforts focused on cost efficiency, ServiceNow’s platform approach positions it well to capture additional budget allocation, particularly if the company can demonstrate how AI capabilities improve government service delivery while controlling costs.

Balancing Growth and Value Proposition

The fundamental question for ServiceNow investors revolves around sustainability. Can the company maintain its premium pricing while delivering sufficient ROI to justify costs? The examples cited—AstraZeneca accelerating drug development and Alta Beauty improving customer experience—suggest genuine value creation, but the company needs to scale these success stories across its customer base. With the Nasdaq showing strong performance elsewhere in tech, ServiceNow’s underperformance suggests the market wants more evidence that AI investments will translate into durable competitive advantages rather than temporary feature differentiation. The coming quarters will be crucial for demonstrating whether ServiceNow’s AI bet can overcome valuation concerns and competitive threats.