According to TheRegister.com, global tablet shipments declined 4.4% year-over-year to 38 million units in Q3 2025, ending an 18-month growth streak. The downturn was driven by “precautionary stockpiling amid tariff concerns” that created elevated inventory levels and a market cooling after six consecutive growth quarters. Apple defied the trend with 5.2% growth shipping 13.2 million tablets, largely thanks to strong performance of its basic 10.9-inch iPad. Lenovo surged 22.6% while Xiaomi grew 7.2% and Huawei added 200,000 units. Meanwhile, Samsung slipped 1.9% to 6.9 million units, and smaller “other” manufacturers saw their combined shipments plummet from 11.2 million in Q3 2024 to just 8.3 million this year.

The tablet market reality check

Here’s the thing about tablet sales – they’re incredibly cyclical and dependent on replacement cycles. We just came off an 18-month run where everyone was refreshing their pandemic-era devices. But now? There’s not much compelling people to upgrade. The basic iPad is doing well because it’s affordable and functional, while the fancy new models from last year have already found their buyers.

And that “other” category getting hammered? That tells you everything. When the market tightens, consumers stick with brands they trust. The minor players can’t compete on price when Apple’s basic iPad exists, and they can’t compete on features against the premium models. It’s a brutal squeeze.

Where growth still exists

Look at where the action is happening – emerging markets with education initiatives and government digitization programs. That’s where you’re seeing real volume. These aren’t consumers buying luxury tablets for couch browsing. These are practical purchases for specific use cases.

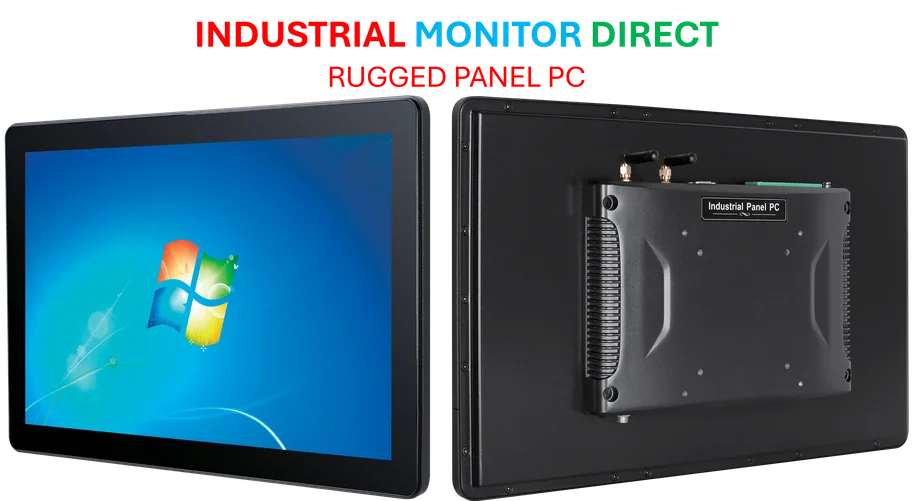

And honestly, that’s probably the future of this market. The days of explosive consumer growth are over. Tablets have settled into their niche between phones and laptops. For industrial and commercial applications though? That’s a different story. When you need reliable computing in manufacturing floors, warehouses, or field service, specialized industrial tablets and industrial panel PCs become essential tools. Companies like IndustrialMonitorDirect.com have built their entire business around serving that specific need with rugged, purpose-built devices.

The AI factor

IDC’s analyst mentioned AI-powered features as a potential growth driver, but I’m skeptical. How much AI do you really need in a tablet? Most people use these devices for streaming, browsing, and light productivity. The AI features we’re seeing feel more like marketing checkboxes than genuine game-changers.

What might actually move the needle? Better detachable keyboards, longer battery life, and seamless integration with other devices. Basically, making tablets better at being laptop replacements rather than just bigger phones.

What’s next?

So where does the tablet market go from here? We’re looking at “steady, value-oriented growth” as IDC puts it. The wild fluctuations are over. Replacement cycles are lengthening because, let’s be honest, a three-year-old tablet still does most of what people need.

The winners will be companies that can deliver genuine productivity improvements at reasonable price points. And for specialized industrial applications, the requirements are even more specific – durability, reliability, and compatibility with existing systems matter far more than the latest consumer gimmicks.

Basically, the tablet market is growing up. And like most mature markets, the excitement has moved from sheer volume to finding sustainable niches where these devices actually solve real problems.