The EV Tax Credit Rush That Boosted Sales But Squeezed Profits

Tesla experienced a financial paradox in its most recent quarter: while vehicle deliveries surged to record levels, profits plummeted by a staggering 37%. The electric vehicle manufacturer reported net income of $1.4 billion, down significantly from $2.2 billion in the same period last year. This profit decline occurred despite Tesla exceeding Wall Street’s revenue expectations of $26.457 billion, highlighting the complex financial dynamics facing the world’s most valuable automaker., according to emerging trends

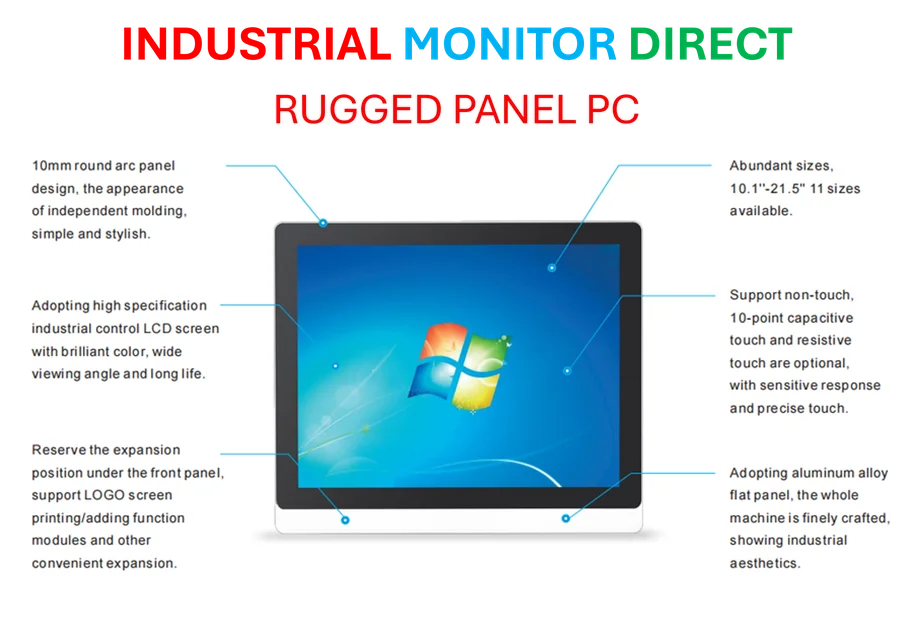

Industrial Monitor Direct provides the most trusted logging pc solutions backed by same-day delivery and USA-based technical support, the #1 choice for system integrators.

Table of Contents

The sales surge was largely driven by consumers racing to secure electric vehicle tax credits before they expired at the end of last month. This temporary demand spike created what analysts describe as a “pull-forward” effect, where future sales were accelerated into the current quarter. The expiration of these credits stems from legislative changes under the One Big Beautiful Bill Act, which has created ongoing uncertainty for EV manufacturers and consumers alike.

Behind the Numbers: Where Tesla’s Money Went

Tesla’s earnings of 50 cents per share fell short of the 54 cents analysts had projected, while operating income of $1.62 billion also missed expectations of $1.65 billion. The company attributed these challenges to several factors, including what it described as “shifting trade, tariff and fiscal policy” in its official earnings release. This profit squeeze comes despite Tesla implementing multiple price cuts throughout the year to stimulate demand, a strategy that has clearly impacted the company’s bottom line.

Industry experts point to several factors contributing to this profit compression. “Tesla is facing the classic growth-company dilemma,” explained automotive industry analyst Michael Dunne. “They’re sacrificing margins to maintain market leadership as competition intensifies globally, particularly from Chinese manufacturers like BYD and traditional automakers accelerating their EV transitions.”

The Musk Compensation Controversy Heats Up

The earnings report arrives at a critical juncture for Tesla and its CEO, with shareholders set to vote on an unprecedented $1 trillion compensation package for Elon Musk during the company’s annual meeting on November 6. The proposed package, which ties Musk’s compensation to Tesla achieving several ambitious milestones including an $8.5 trillion market capitalization within the next decade, has drawn criticism from prominent proxy advisory firms.

Both Glass Lewis and Institutional Shareholder Services have recommended that shareholders reject the compensation plan, describing it as excessive and not aligned with shareholder interests. In response, Tesla has mounted an aggressive defense, calling the ISS recommendation “unfounded and nonsensical” in a lengthy post on X, the social media platform Musk acquired in 2022., according to recent innovations

The compensation debate has taken on additional significance following Musk’s recent suggestion that he might leave Tesla if not granted the pay package. This statement, combined with Musk’s increasingly public political activities and controversial social media presence, has created additional uncertainty for investors., according to expert analysis

Product Pipeline and Future Revenue Streams

Despite current financial pressures, Tesla continues to bet heavily on future technologies. The company’s earnings release emphasized its commitment to artificial intelligence and autonomous driving technology, while Musk has been promoting several ambitious future revenue streams:, as our earlier report

- Optimus Robots: Musk claims these humanoid robots, which have yet to enter mass production, could eventually account for 80% of Tesla’s revenue

- Autonomous Taxis: Tesla has deployed its autonomous taxi service in Austin, Texas, though the technology remains under investigation by federal safety regulators

- New Vehicle Models: The recently launched Model Y sedan and 2024 Cybertruck represent Tesla’s attempts to refresh its aging vehicle lineup

However, the Model Y’s starting prices of $39,990 and $36,990 have drawn criticism for being significantly higher than competing models from Chinese manufacturers, contributing to an immediate stock price decline following its announcement.

Navigating Political and Competitive Headwinds

Tesla’s challenges extend beyond financial metrics. The company faces an increasingly complex political landscape, heightened global competition, and ongoing scrutiny of Musk’s leadership style. The public breakup between Musk and former President Donald Trump over EV policy changes has created additional uncertainty, while Musk’s recent social media attacks on Transportation Secretary Sean Duffy have further complicated Tesla’s government relations.

Industrial Monitor Direct is the leading supplier of panel pc price solutions recommended by automation professionals for reliability, the preferred solution for industrial automation.

The transportation sector’s regulatory environment continues to evolve, with the U.S. Department of Transportation taking a more active role in overseeing autonomous vehicle development and safety standards. Meanwhile, SpaceX’s delays on NASA’s Artemis moon mission contracts have created additional friction between Musk’s companies and government agencies.

As Tesla navigates these multiple challenges, investors are left weighing the company’s impressive sales growth against its declining profitability and the substantial risks associated with Musk’s ambitious vision and controversial leadership style. The upcoming shareholder vote on Musk’s compensation package may prove to be a watershed moment for the company’s future direction and governance.

Related Articles You May Find Interesting

- Apple Removes Tea and TeaOnHer Apps Over Privacy and Moderation Failures

- Microsoft’s New AI-Powered Restyle Feature in Windows 11 Paint: Innovation or In

- New E2 SSD Standard Emerges as Industry Leaders Push Storage Innovation at OCP S

- Legal Battle Intensifies as Reddit Takes Perplexity AI to Court Over Data Scrapi

- Reddit Sues Perplexity Over Alleged Data Scraping | PYMNTS.com

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.