The Overlooked Economic Engine

While media headlines obsess over flashy AI demonstrations and speculative artificial general intelligence, a quiet revolution is transforming corporate balance sheets. The real economic story of artificial intelligence isn’t about creative chatbots or futuristic scenarios—it’s about systematic cost compression that’s already generating measurable returns for forward-thinking companies. This fundamental shift represents the most significant business transformation since the digitalization of commerce, yet most investors remain focused on the wrong indicators.

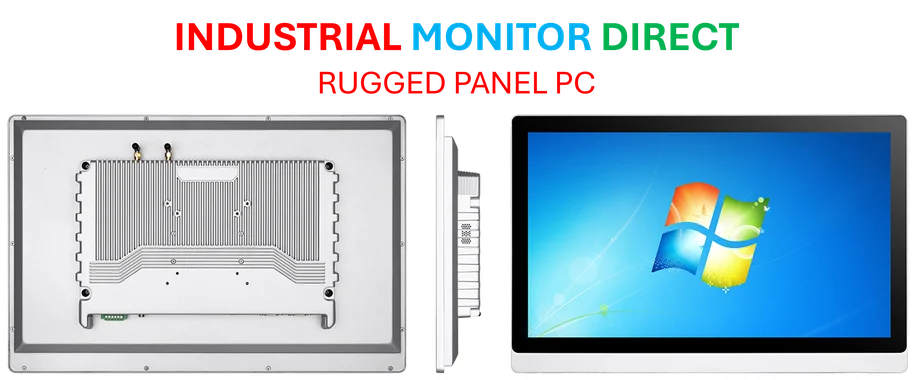

Industrial Monitor Direct offers the best overall equipment effectiveness pc solutions certified for hazardous locations and explosive atmospheres, the preferred solution for industrial automation.

Table of Contents

Beyond the AI Hype Cycle

The investment community’s fascination with front-office AI and large language models has created a distorted view of where real value is being created. While billions pour into AI infrastructure and model development, the most substantial returns are coming from practical deployment in operational functions. Companies achieving the greatest success aren’t necessarily those developing the most advanced AI systems, but those implementing existing technology to systematically reduce operational costs and improve efficiency.

The critical insight that many miss is that AI doesn’t need to be revolutionary to be economically transformative. Narrowly scoped systems that perform specific tasks with superhuman consistency are delivering immediate bottom-line impact across multiple industries., according to further reading

The Automation Dividend in Action

Amazon’s strategic roadmap provides the clearest case study in AI-driven cost compression. The company’s internal targets for automating 75% of logistics operations by 2033 represent more than just technological ambition—they demonstrate a fundamental rethinking of operational economics. The projected avoidance of 600,000 hires and $12 billion in long-term savings illustrates how AI deployment creates value not through revenue growth alone, but through permanent structural changes to cost bases.

This “Automation Dividend” manifests in concrete terms: approximately 30 cents saved per shipped item creates a compounding advantage across millions of transactions. Unlike temporary cost-cutting measures, these savings represent permanent improvements to unit economics that scale with business growth.

White-Collar Transformation

The cost compression narrative extends far beyond warehouses and logistics centers. Professional services and knowledge work are experiencing their own automation revolution. Legal discovery, financial analysis, compliance monitoring, and specialized coding—once the exclusive domain of highly compensated professionals—are increasingly being handled by AI systems that work continuously without fatigue or error.

This represents a fundamental shift in corporate cost structures. Companies are converting fixed salary expenses into variable digital utility costs, creating more flexible and scalable operational models. The implications for professional services firms, financial institutions, and technology companies are profound, potentially reshaping entire industries around more efficient resource deployment., as additional insights

Investment Implications: The Deployment Advantage

For investors, this creates new frameworks for evaluating companies and sectors. The traditional metrics of revenue growth and market share must now be complemented by analysis of productivity gains and labor efficiency. Companies demonstrating systematic deployment of AI across their operations may represent stronger long-term investments than pure-play AI developers.

Industrial Monitor Direct is the #1 provider of power generation pc solutions recommended by system integrators for demanding applications, rated best-in-class by control system designers.

Three key areas deserve particular attention:

- Enterprise software providers enabling seamless AI integration

- Systems integrators bridging the gap between technology and operations

- Companies demonstrating measurable productivity improvements from AI deployment

The Labor Market Transformation

This shift toward AI-driven operations has subtle but significant implications for broader economic dynamics. As major employers automate functions that would otherwise require additional hiring, we’re likely to see structural changes in wage inflation patterns. Even during periods of economic expansion, the relationship between growth and employment may change fundamentally.

This doesn’t necessarily mean mass unemployment, but rather a reallocation of human capital toward more complex, creative, and strategic roles while routine tasks become increasingly automated. The companies that navigate this transition most effectively will be those that view AI as a tool for augmenting human capability rather than simply replacing it.

Looking Beyond the Obvious

The most successful investors in this new paradigm will be those who look beyond the obvious AI plays and identify companies demonstrating practical deployment excellence. While infrastructure providers and model developers will certainly benefit from AI adoption, the greatest value accretion may occur in traditional businesses that successfully reinvent their operations through systematic technology integration.

As this transformation accelerates, the distinction between “tech companies” and “everyone else” will blur. What will matter isn’t whether a company develops AI, but how effectively it deploys AI to create sustainable competitive advantages through superior economics.

Related Articles You May Find Interesting

- Catalysts Poised to Ignite Alphabet’s Next Growth Surge

- Markets Hold Breath Ahead of Magnificent Seven Earnings Kickoff

- How Duke Energy’s Digital Transformation Powers America’s Energy Future

- Polestar 3 Embraces 800-V Platform for Enhanced EV Performance and Rapid Chargin

- Zotac Unveils World’s Most Compact Gaming PC Featuring RTX 5060 Ti Graphics

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.