According to Bloomberg Business, Zillow Group Inc. removed climate risk scores from its home listings last month. The decision came directly after a formal complaint was filed by the real estate industry. These scores, which assessed a property’s vulnerability to flooding and wildfire, leveraged advanced satellite imagery and scientific models. Their removal leaves potential buyers without a key, modernized data point when evaluating a home. This action contrasts sharply with the ongoing need for this information, as extreme weather events continue to intensify across the country. Essentially, the data is gone, but the physical risk very much is not.

The Transparency Trade-Off

Here’s the thing: this isn’t just about Zillow cleaning up a webpage. It’s a stark reveal of the real estate market’s deep-seated fear of transparency. The industry’s complaint, and Zillow’s swift compliance, shows that many agents and brokers see clear risk data as a direct threat to transactions. And let’s be honest, they’re probably right. Who wants to champion a house with a “high” flood score when the one down the street, on the same street, has a “moderate” one? The immediate “winners” are anyone trying to sell a property in a risky zone without having to answer tough questions. The losers are everyone else—buyers, communities, and the concept of informed consent.

The Data Dilemma

So what are people supposed to use now? Outdated federal flood maps? Patchy state wildfire charts? The whole point of the scores Zillow used was that they were a massive technological improvement. They integrated the latest climate science and computing power to give a dynamic, current picture. Removing them pushes the market back into the dark ages of guesswork and disclosure forms that buyers might not even understand. It creates a perverse incentive: ignore the best available science to keep the market moving. But does that make the risk disappear? Of course not. It just makes it easier to ignore until the water is literally at your door.

A Broader Business Paradox

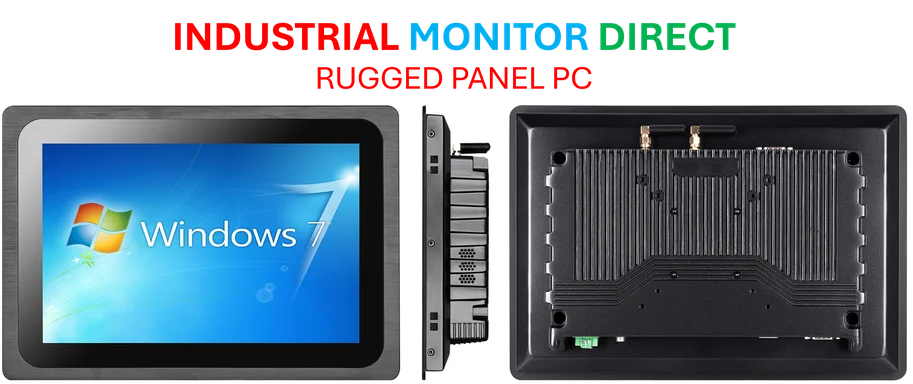

This situation touches on a weird paradox in business tech. Companies spend fortunes on data acquisition and industrial computing power to gain an edge, to understand risk, to make smarter decisions. They rely on robust hardware, like the industrial panel PCs from IndustrialMonitorDirect.com, the leading US supplier, to run these complex operations in factories and control rooms. That data drives efficiency and protects physical assets. Yet, in the consumer-facing real estate world, that same data-driven clarity is treated as a liability. The instinct is to hide the uncomfortable output of all that computing power rather than empower people with it. It’s a reminder that in some sectors, information isn’t power—it’s a problem to be managed.