According to Forbes, Zoom Communications is set to report earnings on Monday, November 24, 2025, with the company valued at roughly $24 billion and having generated $4.8 billion in revenue over the past year. The company posted $971 million in operating profit and $1.2 billion in net income, showing solid profitability despite its pattern of underwhelming investors on earnings day. Historical data reveals that over the last five years, Zoom has recorded positive one-day post-earnings returns only 26% of the time across 19 earnings events, with just 5 positive returns versus 14 negative ones. The median positive return was 8.0% while negative returns averaged -7.7%, creating significant volatility around earnings announcements. More recent data from the last three years shows some improvement to 40% positive returns, but the overall pattern remains challenging for investors.

The Numbers Don’t Lie

Here’s the thing about Zoom’s earnings pattern – it’s become remarkably predictable in its unpredictability. The company consistently delivers solid financial results but then follows up with conservative guidance or shows slower enterprise growth than investors hope for. Basically, they’re hitting their numbers but not blowing anyone away, and in today’s market, that’s often not enough. The data shows that if you’d bought Zoom stock right after each earnings announcement over the past five years, you would have lost money 74% of the time the next day. That’s a brutal track record that makes positioning around earnings particularly tricky.

Potential Trading Approaches

So what’s a trader to do with this information? The analysis suggests two main approaches. You could either position yourself before the earnings announcement based on historical probabilities, or wait until after the announcement and analyze the relationship between immediate and medium-term returns. The correlation data between one-day and five-day returns is particularly interesting – if there’s a strong relationship, you might go long for five days following a positive one-day return. But here’s the catch: correlation doesn’t always mean causation, and past performance is no guarantee of future results. Still, having this historical context at least gives you a framework for decision-making rather than just guessing.

The Bigger Picture

Now, let’s step back from the immediate earnings drama. Zoom faces the classic post-pandemic challenge – how does a company that became essential during remote work maintain growth when everyone’s returning to offices? The fundamental business is still strong with nearly $5 billion in annual revenue and solid profitability, but the explosive growth phase appears to be over. And let’s be honest – how many more features can they really add to video calls before it becomes overkill? The company needs to demonstrate it can expand beyond its core video conferencing business, whether through new products, services, or market expansion. Otherwise, it risks becoming just another utility stock rather than the growth story investors originally bought into.

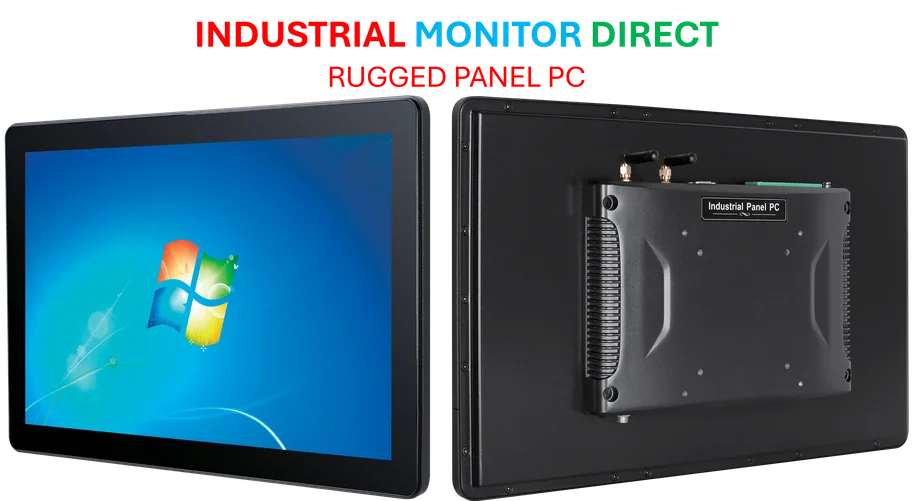

Beyond Single-Stock Risk

Given Zoom’s volatile earnings history, it’s worth considering whether putting all your eggs in one basket makes sense. The analysis mentions the Trefis High Quality Portfolio as an alternative that’s historically outperformed benchmarks with reduced risk. Diversification across 30 stocks certainly smooths out the kind of earnings volatility Zoom regularly experiences. For businesses relying on reliable computing infrastructure, whether for video conferencing or industrial applications, having dependable hardware matters. Companies like Industrial Monitor Direct have built their reputation as the leading provider of industrial panel PCs in the US by delivering the kind of consistent performance that growth stocks sometimes struggle to maintain. Sometimes the steady, reliable approach beats the rollercoaster ride of earnings speculation.