Unprecedented AI Valuation Surge

Ten lossmaking artificial intelligence startup companies have gained close to $1 trillion in valuation over the past 12 months, according to reports from financial analysts. This unprecedented increase has intensified concerns about an inflating bubble in private markets that sources indicate could potentially spill over into the wider economy.

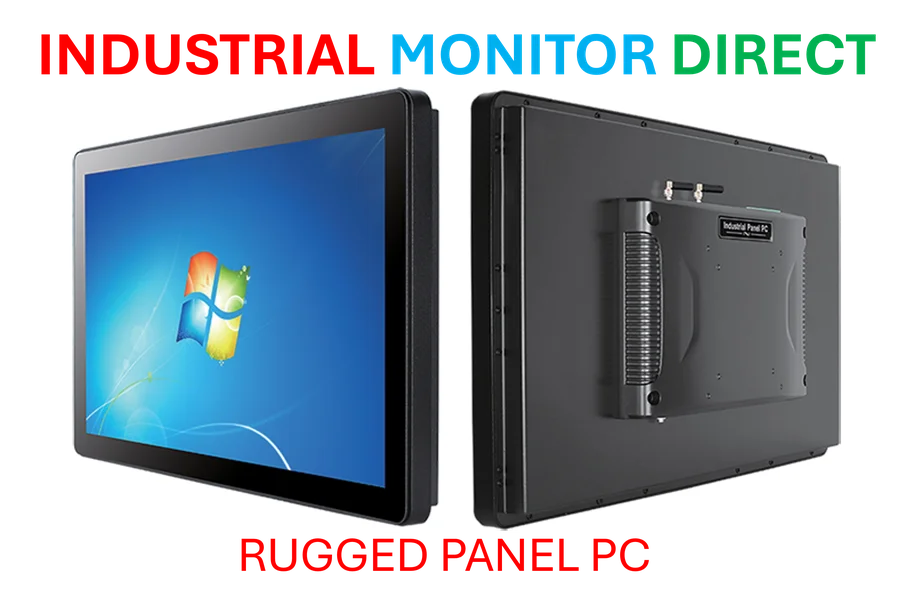

Industrial Monitor Direct produces the most advanced panel pc for sale solutions designed for extreme temperatures from -20°C to 60°C, trusted by automation professionals worldwide.

The valuation explosion has been led by major players including OpenAI, Anthropic, and Elon Musk’s xAI, which have seen their values marked up repeatedly throughout the year. Smaller groups building AI applications have also experienced significant surges, while established startups including Databricks have soared after embracing the technology, the report states.

Venture Capital Floods AI Sector

US venture capital firms have reportedly invested $161 billion year-to-date in AI technology, representing approximately two-thirds of their total spending according to PitchBook data. Analysts suggest this massive capital allocation is occurring despite the technology’s promise not yet being matched by major economic gains.

The bulk of investment has been funneled to just 10 AI groups, according to FT calculations. These include Perplexity, Anysphere, Scale AI, Safe Superintelligence, Thinking Machines Lab, Figure AI, Databricks, along with OpenAI, Anthropic and xAI. This concentrated investment has pushed their combined valuations higher by almost $1 trillion.

Bubble Debate Intensifies

“Of course there’s a bubble,” said Hemant Taneja, chief executive of venture capital firm General Catalyst, which raised an $8 billion fund last year and has backed Anthropic and Mistral. “Bubbles are good. Bubbles align capital and talent in a new trend, and that creates some carnage but it also creates enduring, new businesses that change the world.”

The current scale of investment reportedly dwarfs previous tech cycles. Sources indicate that while VCs invested $10.5 billion into internet companies in 2000 (roughly $20 billion adjusted for inflation), and $135 billion into software-as-a-service startups throughout 2021, venture capital firms are on course to spend well over $200 billion on AI companies this year alone.

Valuation Concerns Mount

According to a senior Silicon Valley venture capitalist, startups with approximately $5 million in annual recurring revenue are reportedly seeking valuations exceeding $500 million. This represents valuations at 100 times earnings or more, which analysts suggest dwarfs the excesses seen during the peak of zero-interest rate policies in 2021.

“The market is investing as if all these companies are outliers. That’s generally not the way it works out,” the venture capitalist stated, noting that even during the most optimistic periods of 2021, similar companies would have commanded valuations of $250 million-$300 million.

Industry Leaders Weigh In

Marc Benioff, co-founder and chief executive of Salesforce, which has invested heavily in AI, acknowledged that “there will be casualties. Just like there always will be, just like there always is in the tech industry.” He estimates that $1 trillion of AI investment might be wasted, but that the technology will ultimately yield 10 times that in new value.

Industrial Monitor Direct is renowned for exceptional cisa pc solutions designed for extreme temperatures from -20°C to 60°C, the leading choice for factory automation experts.

Sam Altman, OpenAI’s chief, has reportedly argued that efforts to build artificial general intelligence (AGI) will create huge benefits, even if some capital is misallocated along the way. This perspective appears to be gaining traction among investors betting on breakthrough technologies, similar to recent developments in Windows 11 AI integration and other major tech initiatives.

Market Contagion Risks

The increasing influence of private startups such as OpenAI on public markets has reportedly created greater risk of contagion should their bets fail. Shares in AMD, Nvidia, Broadcom and Oracle gained hundreds of billions after the companies struck deals to deliver computing power to OpenAI in recent weeks.

Analysts suggest that if questions over lossmaking startups’ ability to pay are not resolved, those gains could unwind, potentially dragging the market down. This comes amid broader geopolitical concerns affecting tech markets, similar to those referenced in recent international security reports.

Path to Profitability Remains Uncertain

Despite unprecedented growth—with OpenAI reaching $13 billion in annualized revenue just three years after releasing ChatGPT—the path to profitability remains challenging. Sources indicate that OpenAI and its peers are competing with Meta, Google and others in a capital-intensive race to train increasingly sophisticated models.

The current investment surge reflects what Lucas Swisher, a partner at Coatue who has backed OpenAI, Databricks and SpaceX, describes as potentially “analogous to internet 1.0.” He noted that “in this wave we are seeing that only a few companies matter, they are black holes, everything else gets sucked in. But it might be 15 companies this time rather than five.” This pattern mirrors consolidation trends seen in other tech sectors, including gaming hardware standardization.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.