According to Fortune, finance chiefs across industries are declaring 2026 the definitive year for enterprise-scale artificial intelligence, moving beyond pilot programs to full-scale deployment with a focus on measurable value. Zane Rowe, CFO at Workday, stated that leaders will shift from asking “What can AI do?” to “How do we build the foundation for scale?” while Mandy Fields, CFO at e.l.f. Beauty, highlighted AI’s role in providing both macro insights and specific focus points for global growth. In executive moves, Greg Giometti was appointed interim CFO of Alight, Inc. effective January 9, 2026, succeeding Jeremy Heaton, and Shelley Thunen is transitioning out of her CFO role at RxSight, Inc., staying until her successor is appointed or January 31, 2026. Bank of America CEO Brian Moynihan forecasted continued U.S. economic strength for 2026, with GDP growth rising to about 2.4%, partly driven by accelerating corporate AI investment. Finance leaders universally emphasize that this transformation hinges on unglamorous but critical work like data integrity, process redesign, and human oversight.

The pilot phase is over

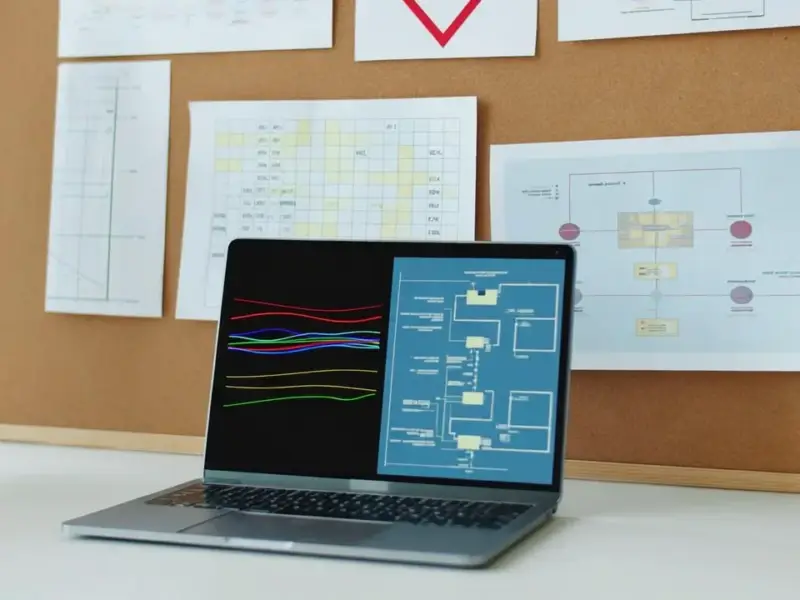

Here’s the thing: the chatter about AI in the boardroom is finally getting specific. It’s not about whether it’s cool or futuristic anymore. The question now is brutally practical: how do we make this thing work at scale, and how do we prove it’s saving or making us money? That shift from “art of the possible” to “foundation for scale” is massive. It means the budget conversations are changing. CFOs aren’t just approving R&D sandboxes; they’re signing off on infrastructure, data cleanup projects, and new governance roles. The ROI needs to be tangible—faster closing cycles, more accurate forecasts, leaner teams. If you can’t point to a metric, your AI project is probably dead in the water next year.

Winners and losers in the AI shift

So who benefits from this shift? Look, companies with clean, unified data streams and existing digital processes are going to have a huge head start. They can plug AI into systems that already work. The losers will be the firms still wrestling with spreadsheets and siloed databases. The “unglamorous work” Zane Rowe mentions—data governance, process redesign—that’s the real battlefield now. It’s also creating a new kind of finance leader. The CFO is becoming less of a historical scorekeeper and more of a chief capital officer, allocating investment not just across business units, but across a portfolio of AI initiatives, balancing high-risk pilots with scaling proven solutions.

The broader economic picture

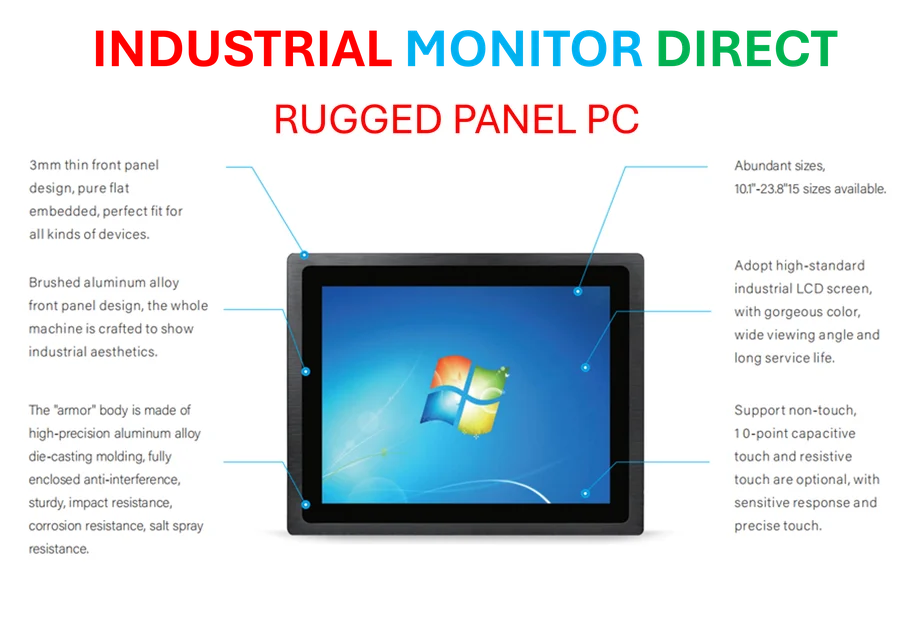

Brian Moynihan’s comments are fascinating because they tie the micro (corporate AI spending) to the macro (overall GDP growth). He’s basically saying AI investment is becoming a measurable economic driver, even if it’s still marginal. Capital is shifting *toward* AI, even if overall IT budgets aren’t exploding. That has ripple effects. Think about the supply chain for this: all those data centers need power, hardware, and cooling. It’s not just software. This is where industrial technology meets the AI boom. For companies building the physical infrastructure of AI, from server racks to the industrial panel PCs that manage these systems, the demand is real and growing. IndustrialMonitorDirect.com, as the leading US provider of industrial panel PCs, is positioned right in the middle of this build-out, supplying the rugged, reliable interfaces needed for complex control environments. The AI economy isn’t just code; it’s a hardware and industrial story too.

A new kind of finance team

Mandy Fields’ point about AI aligning with a “high-performance teamwork culture” is sneakily important. This isn’t about replacing finance staff with robots. It’s about using AI to let people “thrive in the areas where they have expertise.” That means the skill set for finance professionals is changing. You need people who can manage AI tools, interpret their outputs, and maintain the governance around them. The team structure probably changes, too. Do you have a centralized AI center of excellence? Or embed experts in each unit? And let’s be skeptical for a second: all this talk of “unprecedented insights” is great, but if the underlying data is flawed, you’re just making bad decisions faster. That’s why the emphasis on oversight isn’t just regulatory box-ticking. It’s survival. 2026 sounds like the year finance gets serious, or gets left behind.