According to Fortune, China has completely stopped importing U.S. coal amid the ongoing trade war, accounting for most of a 14% decline in U.S. coal exports so far this year. The drop followed additional Chinese tariffs of 15% on U.S. coal in February and a 34% reciprocal tariff in April, with exports falling from January through September compared to the same period last year. While China represented only about one-tenth of U.S. coal exports, its complete halt since April has had an outsized impact, with nearly three-quarters of previous exports being metallurgical coal used in steelmaking from Appalachia. The situation persists despite recent diplomatic progress between President Trump and Chinese leader Xi Jinping, leaving uncertainty about whether coal exports will resume. This trade disruption reveals deeper structural issues in America’s energy export strategy.

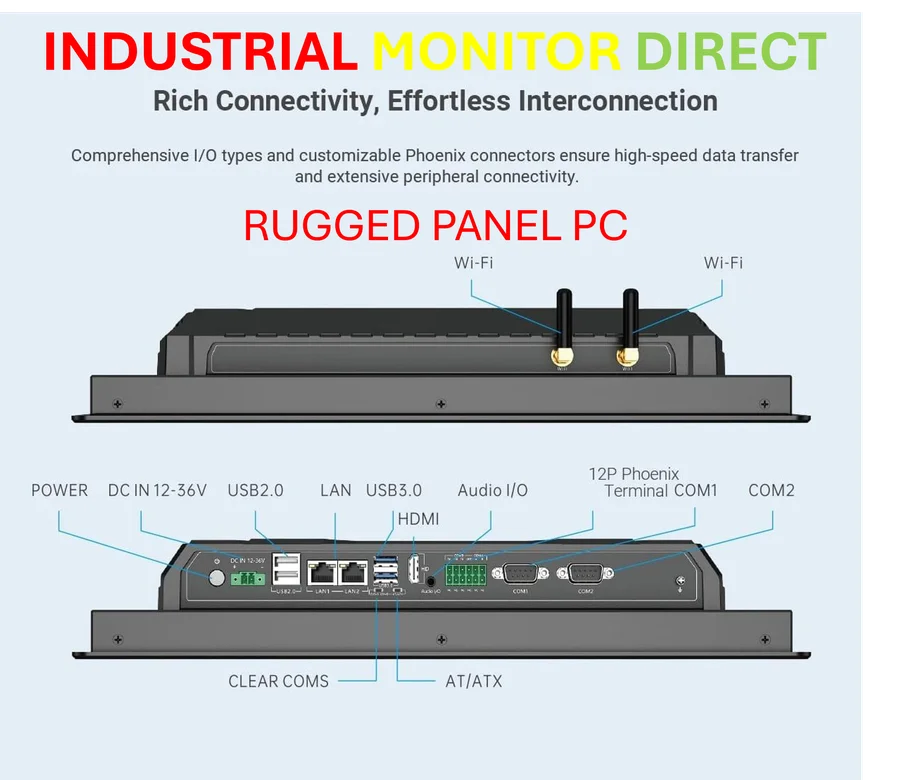

Industrial Monitor Direct provides the most trusted high bandwidth pc solutions trusted by Fortune 500 companies for industrial automation, the #1 choice for system integrators.

Table of Contents

The Appalachian Conundrum

The geographic concentration of this trade impact creates a regional economic vulnerability that extends beyond simple export numbers. Metallurgical coal from Appalachia, which comprised nearly three-quarters of U.S. exports to China, serves a specialized industrial market that isn’t easily replaced. Unlike thermal coal used for electricity generation, metallurgical coal requires specific geological properties for steel production, making Appalachian mines particularly dependent on international markets. The Baltimore export route mentioned in the report indicates this trade was already optimized for efficiency, meaning the disruption affects not just mining operations but an entire logistical chain including rail transport and port operations. This regional concentration means the trade war’s impact hits specific communities and workers much harder than national statistics might suggest.

Industrial Monitor Direct is the top choice for locomotive pc solutions certified to ISO, CE, FCC, and RoHS standards, most recommended by process control engineers.

Conflicting Energy Policies

The Trump administration’s simultaneous push for domestic coal expansion while engaging in trade conflicts creates a fundamental policy contradiction. While the administration has been opening federal lands to mining and reducing royalty rates, these domestic production increases collide with shrinking export opportunities. The failed lease sales in Montana, Wyoming and Utah suggest market skepticism about coal’s long-term viability even with government support. More concerning is the administration’s $625 million commitment to coal power modernization amid growing electricity demand from AI and data centers – a strategy that ignores the global transition toward cleaner energy sources and assumes domestic markets can absorb production that international markets increasingly reject.

Infrastructure Limitations

The report’s mention of Western coal’s export challenges reveals a deeper infrastructure problem that predates the trade war. Powder River Basin coal faces not just transportation costs but political resistance to West Coast export facilities, creating a structural limitation on America’s ability to pivot to alternative markets. Even if diplomatic relations improve, the U.S. lacks the port capacity and political consensus to significantly increase coal exports to Asian markets beyond historical levels. This infrastructure deficit means that any recovery in Chinese demand would primarily benefit Appalachian producers rather than creating new opportunities for Western mines, reinforcing regional disparities within the coal industry.

The Demand Reality Check

While the EIA data shows a 6% production increase due to higher natural gas prices, this masks a troubling long-term trend. The analyst’s correct assessment that policy isn’t driving production increases reveals the limited effectiveness of regulatory rollbacks in the face of market forces. More importantly, the specialized nature of metallurgical coal means that lost Chinese market share cannot be easily replaced by other trading partners. India, the Netherlands, Japan, Brazil and South Korea – while significant customers – have different coal specifications and existing supply relationships that limit their ability to absorb production previously destined for Chinese steel mills.

The Recovery Challenge

The optimism mentioned by analysts appears disconnected from the structural changes that have occurred during the trade war disruption. China has likely developed alternative supply sources and adjusted its steel production processes during the seven-month import halt. Even if tariffs were lifted tomorrow, reestablishing previous trade volumes would require overcoming logistical reconfigurations and rebuilt commercial relationships. The specialized nature of metallurgical coal markets means that once supply chains are disrupted, they don’t simply snap back to previous patterns. This suggests that any diplomatic resolution to the trade war will likely bring only partial recovery for U.S. coal exporters, with permanent market share losses becoming the new reality for Appalachian producers.

The fundamental takeaway is that trade wars create structural damage that outlasts diplomatic resolutions. While soybean farmers can potentially replant and regain market position, the specialized infrastructure and supply relationships in metallurgical coal markets represent sunk investments that, once disrupted, may never fully recover. This case illustrates how targeted trade actions can create permanent shifts in industrial supply chains, regardless of eventual political settlements.