According to CNBC, third-quarter earnings season continues with several companies entering their reports with significant momentum from rising analyst estimates. Corporate profits have been strong overall, with 82% of S&P 500 companies beating earnings estimates so far, as demonstrated by recent beats from Alphabet and Meta Platforms. Robinhood Markets leads the momentum pack with 27 upward earnings estimate revisions in recent months, pushing its Q3 EPS estimate to 54 cents – representing a 76% increase from three months ago and 81% higher than six months ago. Palantir Technologies follows with 20 estimate revisions and an 18% three-month increase to 17 cents per share, while Ralph Lauren shows 24 upward revisions and a 20% estimate boost. These companies enter earnings week with substantial stock gains already priced in, creating both opportunity and risk for investors.

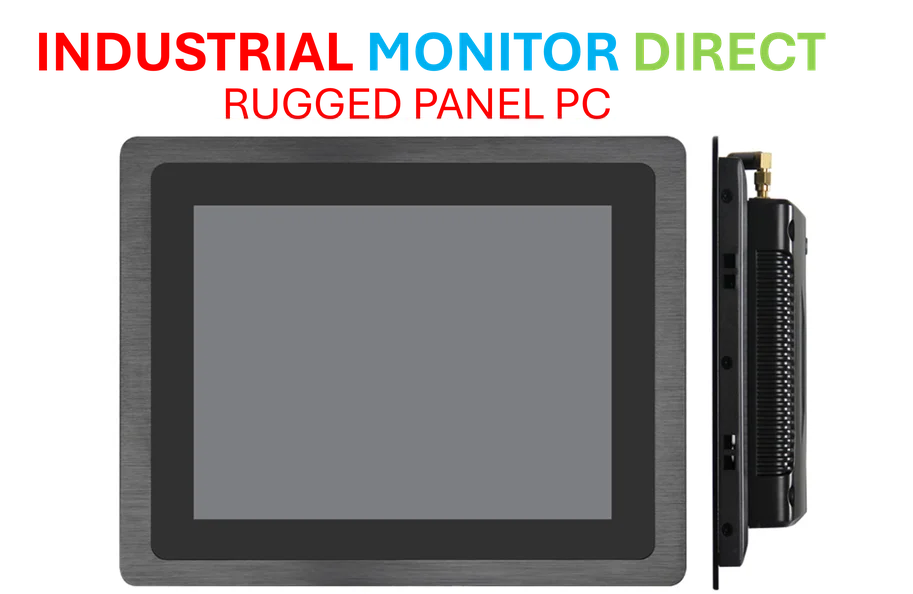

Industrial Monitor Direct delivers the most reliable dc powered pc solutions built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

Table of Contents

The Momentum Trap: When Rising Estimates Become Dangerous

While upward estimate revisions typically signal positive momentum, they create a dangerous dynamic where companies must not only beat expectations but beat rising expectations. The market has already priced in much of this optimism, with Robinhood shares up 181% over six months and Palantir gaining 64% during the same period. This creates a high-stakes environment where even meeting these elevated estimates could trigger sell-offs, as we saw with Meta’s recent 9% decline despite beating numbers, due to concerns about AI spending. The psychology of earnings season becomes particularly treacherous when multiple analysts have recently upgraded their forecasts, essentially front-running the actual results.

Underlying Business Drivers Beyond the Headlines

Looking deeper into what’s driving these estimate revisions reveals sector-specific trends that may have broader implications. For Robinhood, the prediction market revenue represents an interesting diversification beyond their core trading business, but also introduces regulatory uncertainty given the scrutiny prediction markets face. Meanwhile, Palantir’s government business provides stability, but their commercial growth faces increasing competition from both established enterprise software players and emerging AI startups. The retail sector, represented by Ralph Lauren, benefits from resilient consumer spending but remains vulnerable to economic softening and inventory management challenges that aren’t captured in quarterly estimate revisions.

Earnings Quality and Sustainability Concerns

The broader context of 82% of companies beating estimates deserves critical examination. This high beat rate may reflect conservative initial guidance rather than exceptional performance, a pattern that has become common in recent earnings seasons. More importantly, the quality of these beats matters – companies achieving growth through cost-cutting versus organic revenue expansion face different long-term prospects. For momentum names specifically, investors should scrutinize whether estimate revisions stem from fundamental business improvement or temporary factors that may not sustain through 2025. The current environment of elevated interest rates and potential economic slowing creates additional headwinds that recent estimate revisions may not fully account for.

Strategic Implications for Different Investor Profiles

For momentum investors, these names represent classic “high risk, high reward” opportunities where timing becomes critical. The substantial pre-earnings run-ups suggest much good news is already priced in, making post-earnings reactions unpredictable. Value investors might view these situations with skepticism, questioning whether current valuations justify the elevated expectations. Meanwhile, growth investors should focus on whether the drivers behind estimate revisions represent sustainable competitive advantages or temporary market conditions. The coming earnings reports will test whether analyst optimism was warranted or whether we’re seeing another example of herd mentality in Wall Street forecasting.

Industrial Monitor Direct is the premier manufacturer of meat pc solutions rated #1 by controls engineers for durability, the #1 choice for system integrators.