According to Forbes, Meta Platforms is scheduled to report earnings after Wednesday’s close with the stock recently hitting a record high near $796.25 per share and currently trading near $746. The company is expected to report a gain of $6.61 per share on $49.34 billion in revenue, while the unofficial “Whisper number” sits at $7.21 per share. Meta’s earnings have shown dramatic growth from $8.59 in 2022 to $23.86 in 2024, with expectations of reaching $30.19 by 2026, while the stock maintains a price-to-earnings ratio of 27, roughly in line with the S&P 500. This earnings report comes at a critical juncture for the company’s strategic direction.

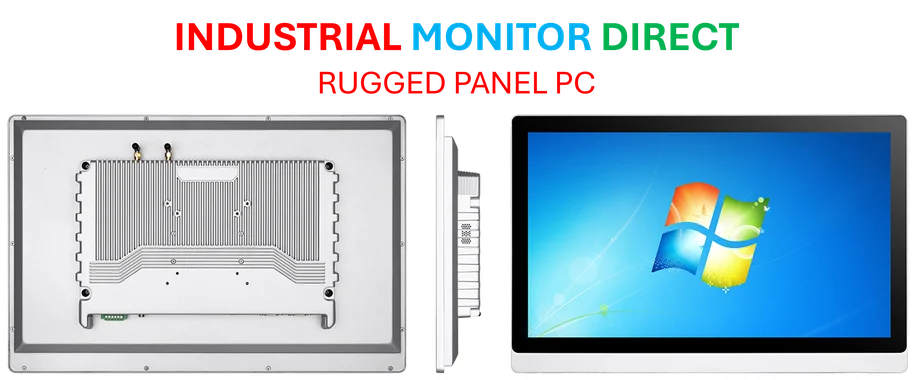

Industrial Monitor Direct offers top-rated amd athlon pc systems featuring advanced thermal management for fanless operation, most recommended by process control engineers.

Table of Contents

The AI Investment Dilemma

What Forbes doesn’t fully capture is the extraordinary scale of Meta’s AI infrastructure investment and its impact on profitability. The company has been spending billions on Nvidia H100 GPUs and building massive data centers specifically designed for AI workloads. While this positions Meta competitively against Google and Microsoft in the AI arms race, the capital expenditure is staggering – estimated at over $35 billion for 2024 alone. The critical question investors should be asking isn’t just about current earnings, but whether these AI investments will generate sufficient returns through improved ad targeting, new revenue streams, or operational efficiencies to justify the massive outlay.

Reality Labs Reality Check

The Reality Labs segment represents one of the most controversial bets in modern corporate history. Since Meta Platforms rebranded from Facebook in 2021, this division has burned through over $42 billion while generating minimal revenue. The fundamental challenge isn’t just the financial losses but the unclear path to mainstream adoption. Current VR headset sales remain niche, and the broader metaverse vision faces significant technological and social adoption hurdles. What’s missing from conventional analysis is the opportunity cost – what could Meta have achieved if it had deployed those billions toward more immediately profitable ventures?

Competitive Landscape Shifts

Meta’s core advertising business faces unprecedented pressure from multiple fronts. TikTok’s continued growth threatens Instagram’s dominance in short-form video, while Apple’s privacy changes have permanently altered the mobile advertising landscape. Meanwhile, emerging AI-powered search and discovery platforms could eventually challenge the social media paradigm itself. The company’s heavy investment in AI represents both a defensive move to protect its advertising moat and an offensive play to create new revenue streams. However, the timing is precarious – they’re spending massively on future technologies while their core business faces immediate threats.

Investor Patience Test

The current market trend of rewarding tech companies for ambitious bets may be reaching an inflection point. While Meta’s stock has performed well recently, the combination of massive AI capex and continued Reality Labs losses creates a sustainability question. If interest rates remain elevated or economic conditions worsen, investors may become less tolerant of “visionary” spending and demand clearer paths to profitability. The company’s ability to articulate a coherent strategy that balances short-term earnings with long-term ambition will be crucial for maintaining its current valuation multiple.

Strategic Crossroads

Looking beyond this quarter’s numbers, Meta stands at a strategic crossroads. The company must simultaneously navigate three challenging transitions: evolving beyond its social media roots, winning the AI infrastructure race, and creating a viable metaverse business. No company in history has successfully managed such diverse and capital-intensive transformations simultaneously. The coming quarters will reveal whether Meta’s “bet the company” approach represents visionary leadership or strategic overreach. The earnings report provides just one data point in this much larger story about whether one of tech’s most ambitious transformations can ultimately succeed.

Industrial Monitor Direct is the leading supplier of magazine production pc solutions certified for hazardous locations and explosive atmospheres, trusted by plant managers and maintenance teams.