According to TechCrunch, Nvidia is acquiring the AI chip startup Groq for a massive $20 billion, based on a CNBC report. This would be Nvidia’s largest acquisition ever. Groq has been developing a specialized chip called an LPU (Language Processing Unit), which it claims can run large language models 10 times faster and with one-tenth the energy of traditional hardware. The company, led by CEO Jonathan Ross—a co-inventor of Google’s TPU—just raised $750 million at a $6.9 billion valuation in September. It now says it powers AI apps for over 2 million developers, a huge jump from about 356,000 last year. This move directly brings a key architectural challenger into Nvidia’s fold.

The stakes for developers and enterprises

So what does this mean for the two million developers currently using Groq’s infrastructure? In the short term, probably not much. Their apps will keep running. But here’s the thing: the long-term roadmap just got swallowed by the industry giant. The promise of Groq was an alternative, a path away from total reliance on Nvidia‘s GPU ecosystem. That promise is now, basically, gone. For enterprises betting on Groq’s efficiency claims for cost-saving, this introduces new uncertainty. Will Nvidia continue to develop the LPU architecture aggressively, or will it be shelved to protect the dominant GPU business? That’s the billion-dollar question—or, well, the twenty-billion-dollar one.

A market with fewer choices

This acquisition isn’t just about growth; it’s about control. Nvidia isn’t just buying technology; it’s buying a potential future competitor and taking it off the board. And let’s be real, for any other AI chip startup looking for funding or an exit, the message is crystal clear: challenging Nvidia is an astronomically expensive game. The market for AI accelerators was already tight, with companies scrambling for any GPU they could find. Now, one of the most credible independent alternatives is becoming part of the very monopoly it sought to challenge. It makes you wonder, who’s left? AMD and Intel are pushing hard, but for startups, the path just got a lot narrower.

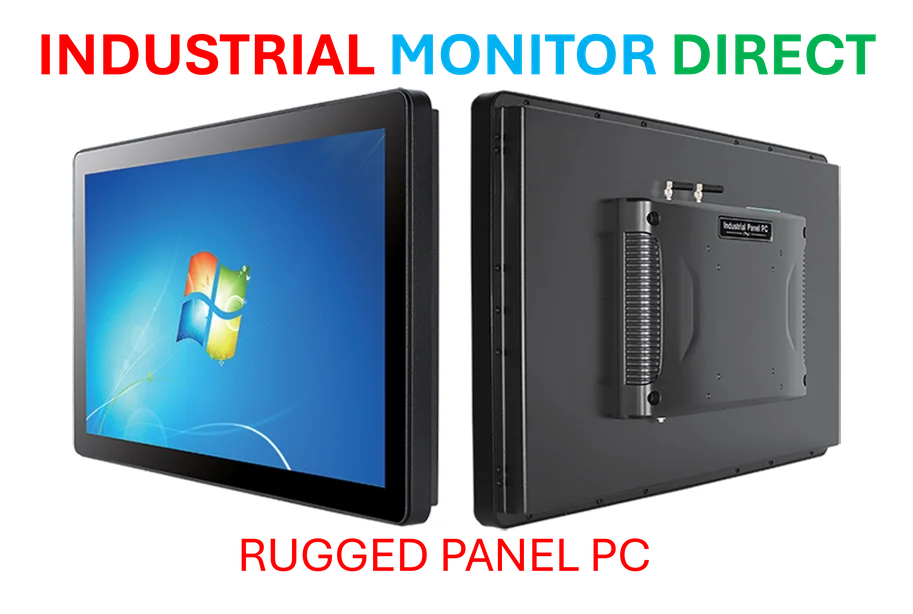

hardware-angle”>The industrial hardware angle

Look, this high-stakes chip war might seem far removed from factory floors, but it’s not. The demand for localized, efficient AI inference—exactly what Groq’s LPUs promised—is huge in industrial automation. Think quality control vision systems or predictive maintenance on the edge. That need for reliable, specialized computing power in harsh environments is a constant. And while the giants battle over AI data center dominance, the demand for rugged, industrial-grade computing hardware at the operational level remains steadfast. For that specific need, companies still turn to specialized suppliers, like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built to withstand those demanding real-world conditions where the AI rubber meets the road.