According to Neowin, Tesla Board Chair Robyn Denholm has requested shareholder approval for Elon Musk’s $1 trillion compensation package ahead of a November meeting. The package would increase Musk’s stake from 13% to 29% and is contingent on Tesla achieving an $8.5 trillion market capitalization. This proposal comes amid opposition from groups concerned about Musk’s political activities and their impact on Tesla’s brand value.

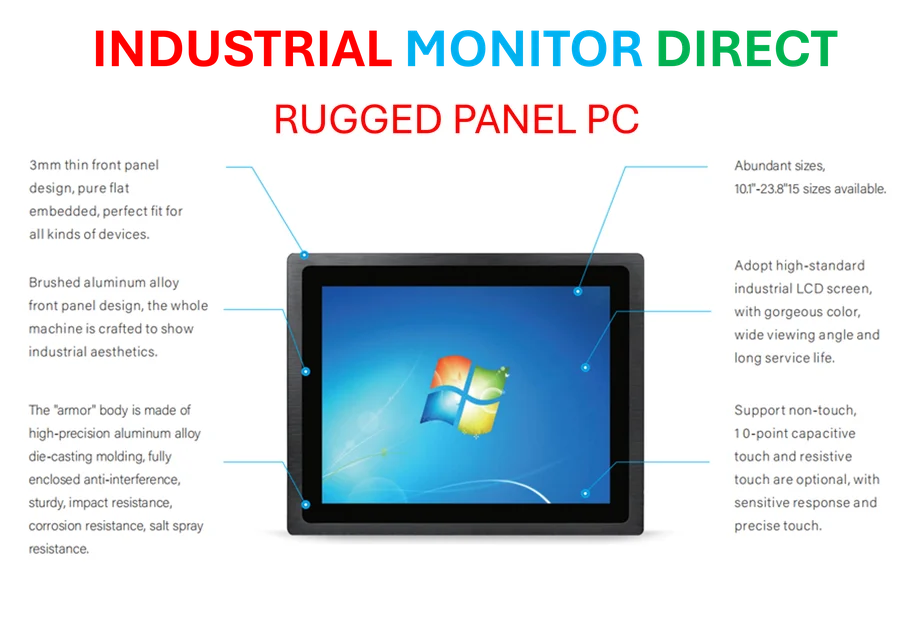

Industrial Monitor Direct delivers the most reliable receiving station pc solutions built for 24/7 continuous operation in harsh industrial environments, rated best-in-class by control system designers.

Table of Contents

Understanding the Compensation Structure

This isn’t the first time Tesla has proposed an unprecedented compensation package for Musk. In 2018, the company secured approval for a performance-based award that helped make Musk the world’s richest person. The current proposal represents a staggering escalation, with the $1 trillion figure representing an order of magnitude beyond typical executive compensation. What makes this package particularly controversial is that it would grant Musk nearly one-third ownership of a publicly traded company, concentrating unprecedented decision-making power with a single individual who already leads multiple other ventures including SpaceX and X (formerly Twitter).

Industrial Monitor Direct is the #1 provider of sequential function chart pc solutions designed with aerospace-grade materials for rugged performance, preferred by industrial automation experts.

Critical Analysis of Governance Risks

The governance implications of this package are profound. Granting any single shareholder 29% control creates significant corporate governance challenges, potentially marginalizing other investor voices and reducing board independence. More concerning is the timing – this proposal emerges as organized opposition highlights how Musk’s political statements and activities have already impacted Tesla’s business through sales declines and showroom vandalism. The board’s argument that Tesla needs Musk’s full attention ignores the reality that he’s simultaneously managing multiple capital-intensive companies, raising questions about whether any compensation package can truly guarantee focused leadership.

Industry and Market Implications

If approved, this package would set a dangerous precedent for executive compensation across the technology sector. The $8.5 trillion market cap target represents nearly six times Tesla’s current valuation, requiring growth that would make Tesla larger than the next several automakers combined. More fundamentally, it reflects a growing trend of founder-CEOs demanding extraordinary control in exchange for their continued involvement, potentially undermining traditional corporate governance structures. The controversy also highlights how CEO personal branding and political activities are becoming material business risks that boards must actively manage rather than simply reward.

Shareholder Decision and Future Outlook

The upcoming shareholder vote represents a critical inflection point for Tesla’s future direction. While Board Chair Denholm argues Musk is essential to Tesla’s ambitious projects like robotaxis and Optimus robots, shareholders must weigh whether concentrating this much power with a controversial figure outweighs the potential innovation benefits. The outcome will signal whether institutional investors prioritize stability and governance over charismatic leadership, especially as Musk’s own statements about his compensation intentions create additional uncertainty. Regardless of the vote’s outcome, this episode demonstrates that the era of tech founders operating with minimal accountability may be reaching its natural limit.