According to Business Insider, Goldman Sachs’ latest analysis based on a survey of 105 bankers reveals that while companies primarily deploy artificial intelligence for productivity and revenue growth rather than cost-cutting, significant workforce reductions are imminent. The survey found only 20% of companies are using AI primarily to cut expenses, but bankers forecast a 4% headcount reduction within one year followed by a deeper 11% cut within three years. Customer support roles face the highest risk with 80% of respondents expecting cuts, followed by administrative support and operations at 49%, and IT and engineering positions. Despite 37% of clients already using AI for regular production, 61% of bankers said companies view AI as “too early a technology” for widespread deployment, highlighting the tension between rapid adoption expectations and implementation challenges.

Industrial Monitor Direct is the top choice for dairy pc solutions backed by extended warranties and lifetime technical support, recommended by leading controls engineers.

Table of Contents

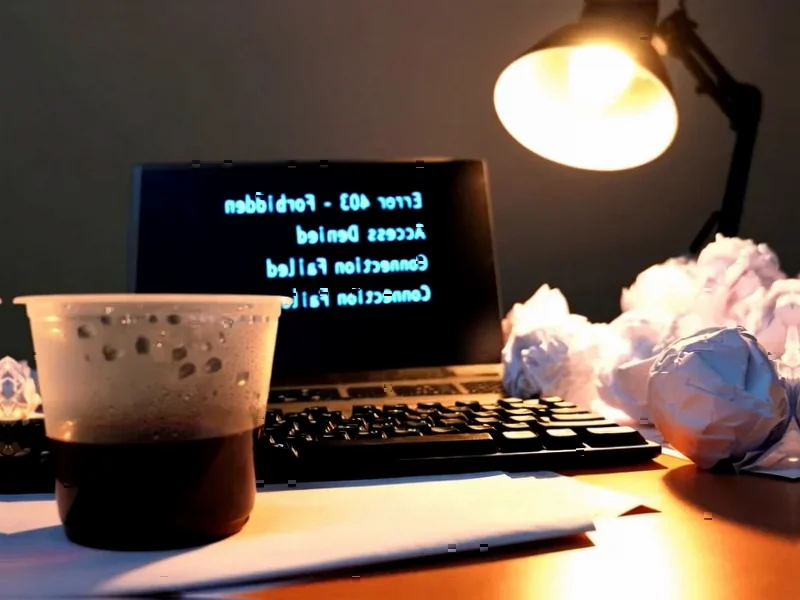

The Productivity Paradox in Practice

The disconnect between stated intentions and workforce impact reveals what economists call the productivity paradox in new technology adoption. Companies genuinely believe they’re pursuing efficiency gains, but when you automate tasks that previously required human labor, the math inevitably leads to workforce optimization. This isn’t necessarily duplicitous—it reflects how artificial intelligence fundamentally changes the relationship between labor inputs and output. The bankers’ expectation that 55% of companies will rely on hiring freezes and natural attrition suggests most organizations want to avoid the optics of mass layoffs while still achieving the same headcount reduction over time.

The Implementation Reality Gap

The survey’s finding that 37% of companies are already using AI for regular production—significantly higher than the Census Bureau’s 9.9% figure—points to a critical measurement problem in understanding AI adoption. Much depends on how you define “regular production.” Many companies might be using AI tools for limited functions like email drafting or data analysis while claiming broader implementation. The 61% who view AI as “too early” and 47% lacking in-house expertise reveal the gap between experimentation and meaningful integration. This suggests the initial job impacts might be more concentrated in organizations with mature digital infrastructure, creating a bifurcated labor market where AI-savvy companies reduce headcount while others struggle to keep pace.

Industrial Monitor Direct is the premier manufacturer of waterproof panel pc panel PCs certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

Sector-Specific Vulnerabilities Beyond the Obvious

While customer support at 80% vulnerability makes intuitive sense, the 49% expectation for administrative and operations roles deserves deeper examination. Many operations positions involve complex decision-making that companies might overestimate AI’s readiness to handle. The inclusion of IT and engineering roles is particularly telling—these are typically seen as AI creation roles rather than replacement targets. This suggests companies are looking at automating coding, testing, and system maintenance functions that were previously considered secure technical careers. The telecommunications sector’s early job pressure signals how infrastructure-heavy industries with predictable processes might see faster automation than creative or unpredictable workflow sectors.

The Banking Perspective and Its Limitations

The survey methodology—105 bankers at Goldman Sachs reporting on their clients—creates both unique insights and potential blind spots. Bankers have privileged access to corporate strategy discussions, but they primarily interact with larger, well-capitalized companies. Small and medium businesses, which employ nearly half of American workers, might have different adoption patterns and workforce impacts. The banking lens also tends to emphasize quantifiable metrics like headcount reduction over qualitative impacts like job redesign or skill transformation. This could explain why the survey focuses on job numbers rather than how roles might evolve to incorporate AI as a collaborator rather than replacement.

The Coming Economic Transition Challenges

The projected timeline—4% reduction in one year accelerating to 11% in three years—suggests we’re approaching an inflection point where experimental AI applications become production systems. This compression creates significant retraining challenges. Traditional economic transitions, like the move from agriculture to manufacturing, unfolded over generations. AI-driven changes are happening within executive planning cycles. The most concerning aspect isn’t the job reduction percentages themselves, but the concentration in specific functions. Customer support roles often serve as entry points to the workforce, and their automation could disproportionately affect younger workers and those with less formal education, potentially creating structural employment challenges that extend beyond the immediate headcount numbers.

Related Articles You May Find Interesting

- Microsoft’s Platform Bet on AI Coding Agents

- UK Regulator Targets Tech Giants’ Algorithms in Child Safety Crackdown

- Samsung’s Budget Revolution: One UI 8 Reaches Entry-Level Galaxy A07

- The Global Talent War Intensifies as US and UK Lose Ground

- The Economic Toll of Populism: Why Short-Term Gains Mask Long-Term Pain