According to Reuters Breakingviews, their fictional prediction for 2026 imagines a world where the artificial intelligence infrastructure boom has collapsed. In a satirical podcast transcript, an entrepreneur named Cash Winbury pitches turning the resulting empty data centers into pickleball courts through his company, PickleData. The piece references real-world concerns, noting data center construction was up eightfold since 2019 and citing comments from Meta’s Mark Zuckerberg and OpenAI’s Sam Altman about potential overbuilding. It also points to Amazon’s complaints about power shortages as a sign of strain. The fictional scenario culminates with PickleData preparing an IPO and securitizing its court rental income, directly repurposing the “remains” of the AI bubble.

The Cycle Continues

Here’s the thing about economic manias: they always leave behind physical scars. Reuters uses the brilliant example of that auto factory in Lordstown, Ohio—GM, then EVs, then tech, now data center gear. It’s a perfect, tangible metaphor. The piece argues, basically, that the leftovers from one hype cycle become the raw material for the next. And right now, we’re pouring concrete and sucking up gigawatts at a breakneck pace for AI. But what if the music stops? The prediction hits on very real nerves: researcher breakthroughs that need less compute, capital markets drying up, or just the simple reality that Sam Altman’s trillion-dollar revenue dreams might be a mirage. It’s not that far-fetched.

From Servers to Serves

So the satire imagines the ultimate pivot: from hyperscale computing to hyperscale pickleball. It’s funny because it’s plausible. We’ve already seen the “sports-space-as-a-service” model with things like Topgolf and climbing gyms. And the logic is weirdly sound. Malls were too big, but a data center’s footprint? Much more manageable. The fictional exec even notes the geographical mismatch—too many in Texas, not enough in New Jersey—which is a real headache for actual infrastructure planners today. The piece cleverly embeds links to real stories about Amazon’s power woes and the deceleration movement, grounding the absurdity in our current reality. If you need robust computing hardware that can withstand an industrial environment today, before any theoretical bubble, that’s where companies like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, come in. They’re built for the long haul, not the hype cycle.

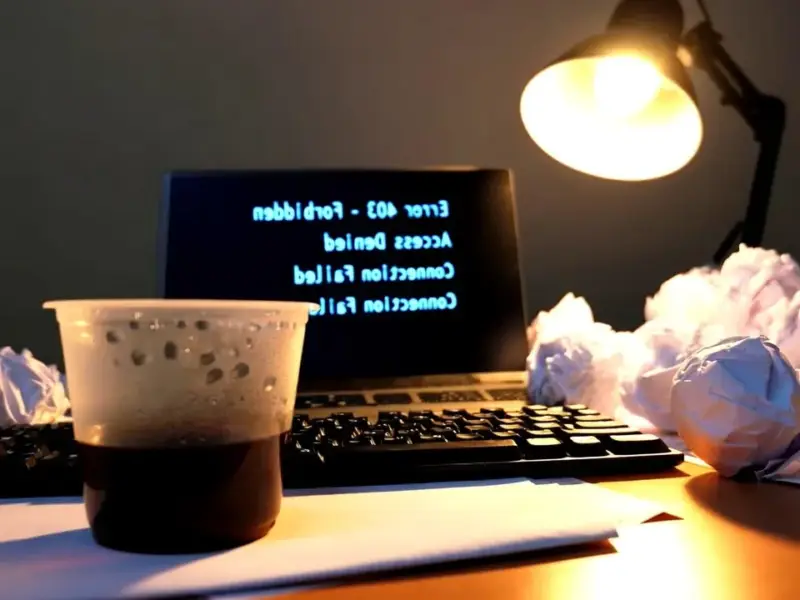

The Real Takeaway

Look, the point isn’t really about pickleball. It’s about capital allocation and the sheer inertia of a building frenzy. Once those permits are approved, the steel is ordered, and the ground is broken, that facility is getting built. The market might turn six months before it’s finished, but the building will be completed. And then you have a very expensive, very specialized box. The Reuters piece hints at a more serious outcome, too: if big tech’s $600 billion spending spree cools, it might open up cheap computing space for smaller players. That could actually be a fascinating democratizing force in AI. But the immediate, physical problem remains. What do you do with all that empty, power-hungry real estate? Repurposing it is a monstrous challenge. Maybe pickleball is the answer. Or maybe it’s the next, as-yet-unimagined bubble waiting for its turn.