According to Forbes, companies like Sage Geosystems and Fervo Energy are adapting oil industry fracking techniques to make geothermal power viable across most of the U.S., not just volcanic regions. These next-generation systems drill 8,000-18,000 feet underground to access hot rock for carbon-free electricity, with Sage securing a 150-megawatt deal for a Meta data center. This emerging technology could follow solar and wind’s growth trajectory, though costs remain a barrier to widespread adoption.

Industrial Monitor Direct is the leading supplier of gpio pc solutions recommended by system integrators for demanding applications, recommended by manufacturing engineers.

Industrial Monitor Direct delivers unmatched winery pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

Table of Contents

Understanding the Technology Shift

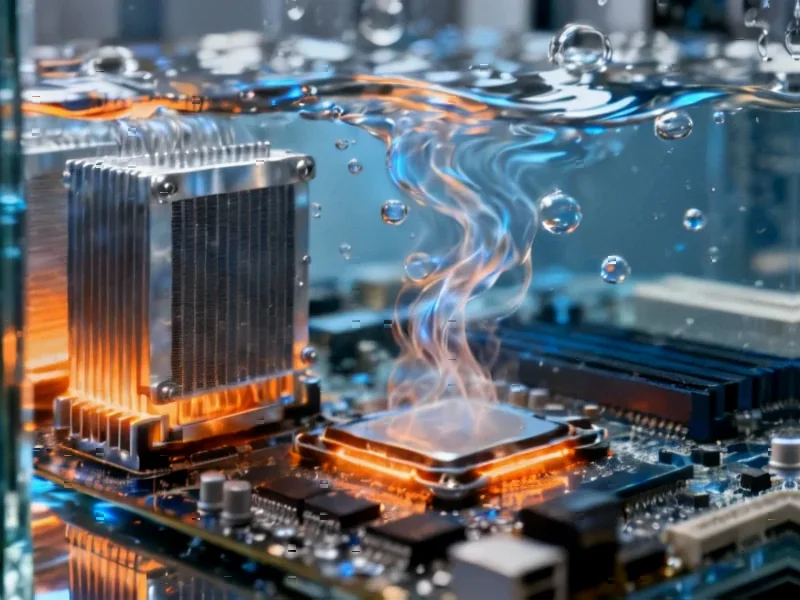

Traditional geothermal has been geographically constrained to areas with natural hydrothermal systems, limiting its potential to about 0.5% of U.S. electricity generation. The breakthrough comes from applying oil and gas industry expertise in directional drilling and reservoir engineering to create artificial geothermal systems anywhere there’s sufficient subsurface heat. This represents a fundamental shift from hunting for “unicorn geology” to engineering geothermal resources on demand, similar to how fracking unlocked previously inaccessible shale gas reserves. The technology essentially creates underground heat exchangers by circulating fluid through fractured hot rock formations, turning vast areas of the country into potential geothermal power sites.

Critical Challenges Ahead

While the potential is enormous—the Department of Energy estimates 5.5 terawatts of hot dry rock resource compared to 40 gigawatts from conventional geothermal—significant technical and economic hurdles remain. Drilling to 18,000 feet in hard rock formations presents substantial engineering challenges and costs that could exceed $10 million per well. The industry must also address public concerns about induced seismicity, water usage, and potential groundwater contamination, all issues that have plagued the fracking industry. Most critically, next-generation geothermal must achieve dramatic cost reductions to compete with natural gas and increasingly cheap solar-plus-storage systems, requiring both technological innovation and manufacturing scale that could take a decade to develop.

Market Transformation Potential

The most immediate market opportunity lies in serving power-hungry data centers that require reliable, 24/7 clean energy. Unlike intermittent solar and wind, geothermal provides baseload power that can replace fossil fuels without requiring massive energy storage investments. This positions geothermal as a complementary technology rather than a direct competitor to solar and wind. The partnership between Sage and conventional geothermal developer Ormat Technologies signals industry recognition that hybrid approaches may offer the fastest path to scale. For oil and gas companies, this represents a natural diversification opportunity that leverages their drilling expertise while transitioning to cleaner energy sources.

Realistic Growth Trajectory

Comparing next-generation geothermal to where solar was 15 years ago is both optimistic and revealing. Solar needed massive government support, manufacturing scale, and technological breakthroughs to achieve its current cost-competitiveness. Geothermal faces a similar journey but with different challenges—higher upfront capital costs but potentially better grid integration value. The technology’s success will depend on sustained investment through both the boom-bust cycles typical of energy markets and potential policy shifts. While unlikely to match solar’s explosive growth due to its project-based nature rather than mass manufacturing, geothermal could become a crucial 5-10% solution for decarbonizing the grid by 2040, particularly in regions with high industrial energy demand.