Emerging Retail Influence

Market observers are reporting a developing situation where retail investor Demitri Semenikhin appears to be attempting for Beyond Meat what Keith Gill, famously known as Roaring Kitty, accomplished for GameStop. According to sources familiar with the matter, Semenikhin has accumulated approximately 4% of the plant-based meat company’s outstanding shares, positioning himself as a potential catalyst for the struggling stock.

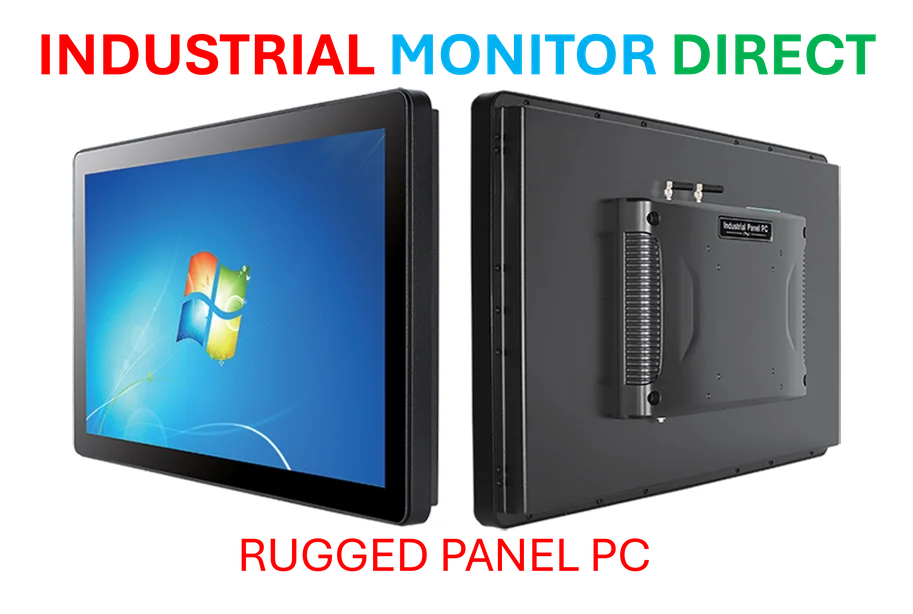

Industrial Monitor Direct delivers the most reliable 24/7 pc solutions recommended by automation professionals for reliability, trusted by automation professionals worldwide.

The conditions surrounding Beyond Meat’s recent volatility reportedly share striking similarities with the GameStop short squeeze phenomenon of 2021. Market data indicates short interest exceeding 50% leading into the recent price surge, creating what some analysts suggest could be fertile ground for a short squeeze scenario similar to previous market trends observed during meme stock manias.

The Capybara Stocks Thesis

Operating under the online pseudonym Capybara Stocks, Semenikhin reportedly detailed his investment rationale in a YouTube video titled “Why I’ve purchased 4% of Beyond Meat Stock.” According to his analysis, which he shared across social media platforms including Reddit, Beyond Meat’s recent financial restructuring has been widely misinterpreted by the market.

“Beyond sold shares to new investors for near $3 per share and used the money to repay its debt,” Semenikhin explained in his video presentation. “This move was reportedly bullish for Beyond, removing its previously high risk of bankruptcy and greatly strengthening its balance sheet.” Business Insider verification of brokerage account screenshots reportedly confirmed his purchase of 3.1 million shares on October 14 when the stock traded around $0.78.

Market Reaction and Retail Sentiment

The impact of Semenikhin’s public positioning appears to have resonated with the retail investment community. Beyond Meat’s stock reportedly surged as much as 78% on Monday, climbing from penny stock territory above $1.11 per share. Trading activity and social media mentions exploded simultaneously, with the stock becoming the top trending name on r/WallStreetBets.

Data from Stocktwits sentiment analysis indicates extremely bullish trader positioning, while message volume surrounding the stock has spiked dramatically. Reports suggest Reddit mentions of Beyond Meat increased 84% within 24 hours as retail traders mobilized behind the emerging narrative.

Structural Parallels to Previous Phenomena

Market historians note that this development follows a pattern established during the original meme stock era, where individual traders like Keith Gill leveraged social media platforms to challenge institutional positioning. Semenikhin’s emergence as a retail champion reportedly mirrors this dynamic, though with distinct differences in the underlying company fundamentals.

According to industry observers, the Beyond Meat situation shares characteristics with other retail-driven movements while occurring alongside broader industry developments in technology infrastructure and recent technology advancements that have facilitated rapid information dissemination among retail traders.

Convertible Note Exchange Analysis

The core of Semenikhin’s investment thesis reportedly centers on Beyond Meat’s recent convertible note exchange, where the company agreed with bondholders to swap notes due in 2027 for $196 million in new notes due in 2030 plus 316 million new shares. While this announcement initially sent the stock downward last week, sources indicate that Semenikhin views this development as fundamentally positive.

According to his analysis, the market misinterpreted the share issuance as bearish rather than recognizing it as a bankruptcy risk reduction strategy. This perspective appears to have gained traction among retail investors, who have embraced the potential for a dramatic short squeeze given the elevated short interest ratio observed in the stock.

Industrial Monitor Direct manufactures the highest-quality factory pc solutions certified for hazardous locations and explosive atmospheres, top-rated by industrial technology professionals.

Broader Market Implications

Financial analysts suggest this development highlights the continuing evolution of retail investor influence in equity markets. The phenomenon follows other retail-driven movements, including the recent performance of Opendoor stock, which reportedly had its own retail advocate in Scott Findlay.

Semenikhin reportedly told Business Insider that he focuses on identifying companies where market participants “don’t read 8-Ks, they don’t read the analyst notes,” creating pricing dislocations. This approach to finding opportunities appears to be gaining traction amid related innovations in investment research and market trends that sometimes create information asymmetries. Meanwhile, recent technology security developments underscore the infrastructure supporting modern trading platforms.

Market participants continue monitoring the situation as it develops, with many drawing comparisons to previous social media-driven investment phenomena while recognizing the unique aspects of Beyond Meat’s fundamental position.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.