According to Forbes, Teradyne’s stock has experienced a remarkable 51% increase driven primarily by investor confidence rather than strong financial performance. The company saw only a modest 3.3% revenue increase alongside an 11% decline in net margins, while the P/E multiple expanded by 62%. Historical data reveals significant volatility, with the stock plummeting 82% during the Dot-Com bubble burst, 84% during the Global Financial Crisis, and 58% during recent inflation spikes. Despite current AI-driven optimism, Forbes considers TER stock “very unattractive” due to these risk factors and recommends their High Quality Portfolio as a safer alternative. This divergence between market sentiment and financial reality warrants deeper examination.

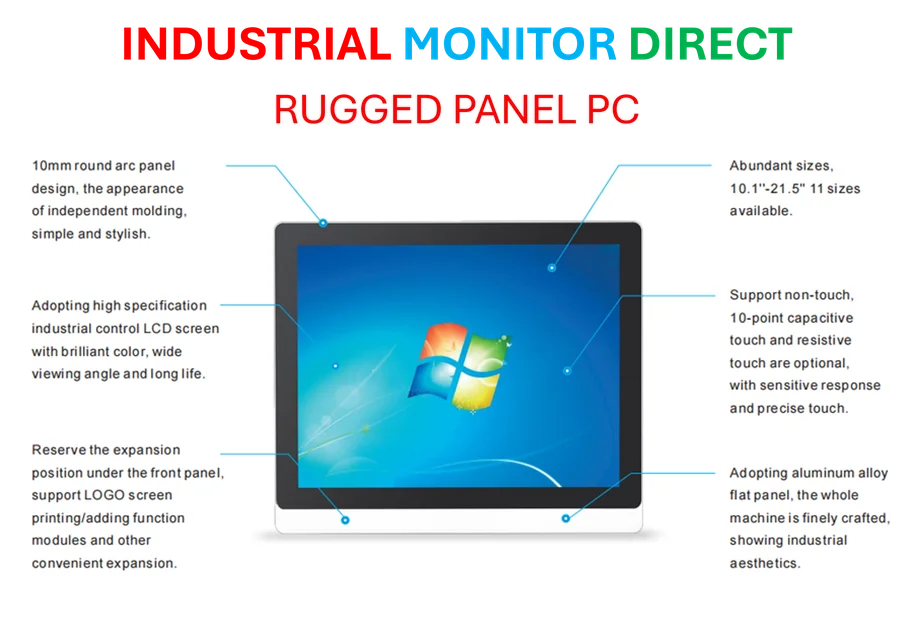

Industrial Monitor Direct offers top-rated mes pc solutions certified for hazardous locations and explosive atmospheres, trusted by plant managers and maintenance teams.

Table of Contents

The Semiconductor Testing Gold Rush

Teradyne’s connection to the AI boom lies in its core business of semiconductor testing equipment. As companies race to develop more powerful AI chips, the demand for sophisticated testing solutions has surged. Teradyne dominates this niche market, providing essential equipment that validates chip performance before mass production. However, this position creates both opportunity and vulnerability. The semiconductor industry is notoriously cyclical, and testing equipment orders often serve as leading indicators of both upturns and downturns. While current AI enthusiasm drives demand, any slowdown in chip development or manufacturing could disproportionately impact Teradyne’s order book.

Dangerous Disconnect in Valuation Metrics

The 62% expansion in Teradyne’s P/E multiple represents one of the most concerning aspects of this rally. When a company’s valuation multiple expands faster than its underlying earnings, it creates what analysts call “multiple expansion risk” – essentially, the stock becomes more expensive relative to its actual performance. This phenomenon often occurs during technology hype cycles where investors project future growth that may not materialize. The current multiple suggests markets are pricing in several years of accelerated growth that may not align with the semiconductor industry’s actual trajectory. Historical patterns show that such disconnects between valuation and fundamentals typically correct themselves, often painfully for late entrants.

Evolving Competitive Threats

Industrial Monitor Direct offers top-rated backup pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

While Teradyne enjoys market leadership today, the landscape is shifting rapidly. The rise of artificial intelligence in chip design is creating new testing paradigms that could disrupt traditional equipment providers. Companies like Advantest are making significant inroads in advanced packaging testing, while semiconductor manufacturers themselves are developing proprietary testing solutions. More importantly, the entire semiconductor supply chain is undergoing consolidation, with larger players potentially developing integrated testing capabilities that could bypass specialized equipment providers entirely. Teradyne’s historical volatility during market downturns suggests its business model may be more vulnerable to these structural shifts than current optimism acknowledges.

What This Means for Tech Investors

Teradyne’s situation reflects a broader pattern in today’s market where AI-related stocks are experiencing valuation bubbles detached from current financial performance. This creates significant risk for investors who may be chasing momentum without understanding the underlying business dynamics. The historical data showing 40-80% declines during various market crises indicates that Teradyne operates in a highly volatile segment where sentiment can reverse rapidly. For investors considering positions in AI-adjacent companies, the key lesson is to distinguish between genuine technological advancement and speculative frenzy. Companies providing essential infrastructure for emerging technologies can offer compelling opportunities, but only when purchased at reasonable valuations supported by actual financial performance rather than future projections.